Official Record/Exits

Oakley exits WebPros to CVC and re-invests

Exit sees Oakley re-invest for a minority stake and returns of 6.7x and 140% IRR in total

FSN sells Fitness Word to Pure Gym

Buyer has been owned by US buyout house Leonard Green & Partners since late 2017

Souter takes majority stake in Stone restructuring

Several LPs in RJD's fund have reinvested in the new vehicle, including the RJD partners themselves

Apax Partners, UI Gestion et al. back Routin SBO

Previous backer Crédit Mutuel Equity reinvests in the French syrup and liquor producer

Agilitas sells Recover Nordic to EQT

EQT deploys capital from its EQT VIII fund, which hit its €10.75bn hard-cap in 2018

NorthEdge sells DHG to ArchiMed for 3x return

During NorthEdge's holding period, the company made bolt-ons such as Nightingale, Kirton and Qbitus

EQT exits ITS Learning to trade

Sale ends a six-year holding period for EQT, which bought the company via EQT Expansion Capital II

PAI Partners buys Armacell from Blackstone

Deal is based on an EV of €1.4bn and will see minority owner Kirkbi maintain a stake

Ardian exits CCC to Telus

Canadian listed telecoms company buys the business for an EV of €915m

Jet Investment exits MSV Metal Studenka

Sale ends a six-year holding period for the GP, which bought the company via its Jet I fund

Albion sells Bravo Inns for £17.9m

Enterprise value of the company represents an entry multiple of 6.8x for the acquirer

Green Arrow buys Poplast from EOS

Green Arrow invests via its third fund, which held a final close on €230.6m in September 2018

IK Investment Partners acquires Ondal from Capvis

Ondal is the GP's third recent medtech acquisition and the 15th investment from IK VIII

Norvestor exits Johnson Metall Finland

Sale ends a 12-year holding period for the GP, which bought the company via its Norvestor IV fund

Elysian to reap at least 3.2x on Pebble IPO

Listing results in a 3.2x return, with the remaining stake currently representing an extra 1.1x

Sovereign to sell Arachas for €250m

Sovereign backed the management buyout of Arachas in 2017 and acquired a controlling stake

Apax France sells Sylpa to ActoMezz-backed management

Sale ends a four-year holding period for Apax France, which owned a stake in Sylpa via Apax Development

Ambienta sells Energy Wave to EQT-backed Antas

Sale ends a two-year holding period for Italian GP Ambienta, which owned a majority stake in Energy Wave

Norvestor sells Cegal to DWS-, Argentum-led consortium

Transaction is made via a special purpose vehicle, Norvestor SPV I, which will own 75-80% in the company

Apax acquires Destiny in SBO

Destiny founders retain almost 30% of shares in the company in the secondary buyout transaction

Idinvest exits Bimedia to trade in €50m deal

Deal ends a four-year holding period for Idinvest Partners, which backed the company alongside Omnes

EQT exits EIS Aircraft to Hannover Finanz

Exit follows the 2018 sale of the group's Aircraft Operations division

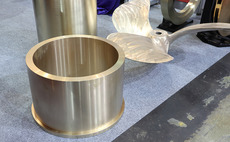

DeA Capital's Idea CCR I sells Sinterama to trade

Sale ends a two-year holding period for CCR I, which owned a majority stake in the business

Indaco sells AdmantX to Vista Equity-backed IAS

Following the deal, AdmantX will be integrated within the new group and its brand absorbed under IAS