Official Record

Vivalto Partners buys majority stake in Vivalto Santé

New investors IK Partners and Hayfin are backing the deal, as well as incumbents such as Mubadala

Speedinvest launches EUR 80m Climate & Industry Opportunity fund

Fund is intended to back the VC's existing industrial and climate technology startups

FSN sells EET to Pamplona in SBO

Pamplona Capital Management has agreed to acquire Nordic technology distributor EET Group from FSN Capital in a secondary buyout.

IK to buy Renta Group from Intera

Intera formed the construction machinery and equipment firm in 2015 via a three-company merger

Partech closes second growth fund on EUR 650m

Second vehicle is significantly larger than its predecessor, Partech Growth I, which raised EUR 400m in 2015

Tenzing raises GBP 100m Belay Fund

Vehicle can invest up to GBP 150m and will back the GP's Tenzing II portfolio companies

VCs in USD 156m round for Quell Therapeutics

Series B for the Treg therapy developer was led by VCs including Jeito Capital and Ridgeback Capital

Searchlight invests in Celestyal Cruises

Searchlight is investing in the cruise operator via its Searchlight Opportunities Fund

Motorway raises USD 190m in Series C

Index Ventures and Iconic Growth have co-led a USD 190m funding round for Motorway, valuing the UK-based used car sales platform at more than USD 1bn.

LBO France buys ID Market, Sourcidys

GP is investing via its Mid Cap strategy and will merge the B2C and B2B home and gardening retailers

Bencis sells TBAuctions in SBO to Castik

Bencis formed TBAuctions in 2018 when it combined BVA Auctions with Troostwijk Veilingen

Capiton holds EUR 504m final close for sixth fund

Capiton VI is now 36% deployed across seven deals and expects to make up to 15 platform investments

TA Associates buys Ambienta's Nactarome

TA beat contender Apax, which came second in the auction for the Ambienta-backed company

CVC exits Etraveli in EUR 1.63bn trade sale

CVC acquired the online flight booking platform from ProSiebenSat.1 in 2017 in a EUR 508m deal

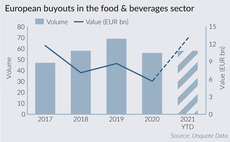

Food and beverage buyouts to reach EUR 13bn in 2021

An average of 44 buyouts totaling EUR 5.1bn were completed in the sector from 2011-2020

Advent buys Caldic from Goldman Sachs

GP plans to merge the speciality chemicals producer with São Paulo-headquartered Grupo Transmerquim

UVC holds final close for third fund

UVC Partners has a deployment capacity of EUR 255m with its flagship fund and new Opportunity Fund

CVC buys Unilever's tea business for EUR 4.5bn

European food and beverage buyouts are now set to reach EUR 13bn in 2021, according to Unquote Data

ArchiMed buys Cardioline

Cardiology telemedicine platform is the first deal from the GP's EUR 650m MED III fund

Tencent leads GBP 60m round for Ultraleap

Company develops haptics hardware technology, allowing touch-free interaction with devices

Balderton raises USD 600m for eighth flagship fund

Fund will continue the VC's Series A-focused strategy, targeting European startups

Sofinnova holds EUR 150m close for third biotech fund

Impact fund has made two investments as of its interim close and expects to make 10-12 in total

Carlyle clinches AutoForm in SBO from Astorg

Permira, Onex, EQT, KKR and Hellman & Friedman, as well as industry players, were also tipped as potential bidders

Graphite buys Opus Talent Solutions

Deal is the eighth investment from the GP's GBP 500m Graphite Capital Partners IX fund