Official Record

Gimv increases stake in GPNZ

Gimv has increased the size of the majority stake that it already held in the dental chain

Inflexion sells Reed & Mackay to trade

Sale of the corporate travel business to US-based TripActions is the GP's fifth exit in six months

Astorg buys Solina from Ardian

Sale ends a five-year holding period for Ardian, which acquired Solina from IK Investment Partners

Xenon closes small-cap fund on €85m

Xenon Small Cap Fund is dedicated to investments in Italian companies generating EBITDA of up to €3m

Seco floats in €397m IPO

Sellers include FII, which owns a stake in Seco via its Fitec fund, and the company's founders

Gyrus holds close for Gyrus Investment Program

Program comprises Gyrus Principal Fund and its co-investment Cortex fund; it has a тЌ400m hard-cap

Hannover Finanz, Arcus acquire Löwenstark

Mittelstand-focused GPs aim to support the online marketing firm's growth and succession planning

Amadeus V Technology Fund closes on £110m

Fund invests in seed and series-A startups specialised in science and engineering-led innovation

Hg sells EidosMedia to Capza

Sale ends a six-year holding period for Hg, which acquired a majority stake in Eidosmedia firms Wise and Aksia

Founders Circle closes third fund on $355m

Fund deploys flexible capital to meet the needs of growth-stage companies and support their expansion

Gimv buys minority stake in Projective Group

Digitalisation consultancy and recruitment business intends to pursue a buy-and-build strategy

Meridia exits food ingredients producer Sosa

This is the second exit inked by the GP's debut fund, Meridia Private Equity I, following the sale of KIpenzi

VC-backed Darktrace lists on LSE

Cybersecurity platform has a market cap of around ТЃ1.7bn; it raised its first funding round in 2013

Greyhound leads $160m series-D for TravelPerk

This injection, which includes both equity and debt, brings the total capital raised by TravelPerk to date to $294m

Ares closes Ares Capital Europe V on €11bn

Ace V is Ares' largest institutional fund yet and is 70% larger than its тЌ6.5bn predecessor

Corpfin sells Secna to EQT's Chr Hansen

Sale ends a six-year holding period for Corpfin, which bought a 51% stake in the company via its €255m fund IV

Capza closes fifth debt fund on €1.6bn, prepares new launch

Fund invests in SMEs with EBITDA of more than €12m, providing unitranche and mezzanine

Permira buys minority stake in New Immo Group

Existing investor Qualium Investissement is to retain a stake in the digital real estate platform

MessageBird raises $800m series-C extension

The $1bn funding is reportedly Europe's largest ever series-C round

Bain Capital, JC Flowers back Co-operative Bank

Bain Capital and JC Flowers become investors in the bank alongside its five other current financial sponsors

VCs in $75m round for Kaia Health

Digital physical therapy platform is backed by all existing investors, including Balderton Capital

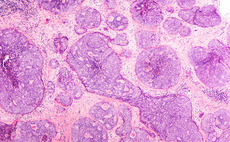

Novo Seeds, Ysios Capital lead €51m round for Adcendo

RA Capital Management, HealthCap and Gilde Healthcare also take part in the round for the biotech startup

Bain sells Fedrigoni's security business to Epiris's Portals

Sale comprises Fedrigoni's facilities specialised in the production of security paper for banknotes and documents

Lumos leads €70m series-C round for OpenClassrooms

Education technology company also attracts Salesforce Ventures, Chan Zuckerberg Initiative and GSV Ventures