Official Record

Investindustrial buys Campus Training

GP intends to create a platform for new acquisitions across the professional education sector in Spain

Norrsken, Partech lead €5m round for Material Exchange

Startup was founded last year and has reportedly raised $8.2m so far

Kinnevik leads $70m series-C for HungryPanda

Kinnevik joins new investors Piton Capital, BurdaPrincipal Investments and VNV Global

G Square backs €40m round for Medadom

France-based telemedicine startup intends to use the fresh capital to expand its domestic presence

Mobeus sells stake in Advantedge for 30% IRR

Mobeus reported a 2.7x return on the sale to ECapital, a provider of alternative financial products

Certior holds first close on €35m for special opportunities fund

Fund has a target of тЌ75m and is due to hold a final close in May 2021

CVC makes €175m offer for Vivartia

Marfin Investment Group, the Greek financial entity, is the vendor of the company

TriSpan Opportunities Fund II holds first close

Fund focuses on investment opportunities in the lower-mid-market across North America and Europe

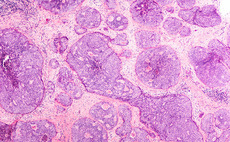

Kartesia in €32m refinancing for Enterprise-backed Nu-Med

Enterprise Investors acquired a minority stake in the oncology company in 2013

Liberta Partners acquires Forteq Healthcare

Deal is a carve-out from Forteq Group and marks the fourth investment from Liberta Partners II

Cadence Growth Capital invests in PlusDental

Germany-headquartered dental platform is Cadence Growth Capital's third investment

LDC sells NBS to TA-, Stirling-backed Byggfakta

Bank of America was given the mandate to run the sale process for the company in September 2020

ProFounders leads €4.1m series-A for Nodalview

Company intends to use the fresh capital to scale up its team, while boosting its growth and expansion

Flexstone invests €6.3m in ProA-backed Pastas Gallo

With Flexstone's support, the business plans to further bolster its expansion, launch new products and boost its growth

Scottish Equity Partners invests in Dohop

With SEP's support, Dohop intends to scale up its team and expand its global sales

PAI-backed Stella Group buys BPE's DuoTherm Rolladen

Exit ends BPE's three-and-a-half-year holding period; the add-on is Stella's second under PAI

Axcel buys three staffing agencies

Combined group generates revenues of DKK 850m and employs 150 staff across 11 offices in Denmark

Chequers, Paragon to acquire Silverfleet's 7days

Sale process for the medical workwear company saw interest from FSN and Gilde, Mergermarket reported

VCs in €3.5m round for Cumul.io

Stijn Christiaens, co-founder and CTO at Collibra, will continue to act as an independent board member

EMZ Partners acquires Assepro

Buyout of the Switzerland-based insurance broker is EMZ's third DACH region deal of 2020

Abris Capital buys Scanmed for PLN 340m

GP invests in the company via Abris CEE Mid-Market III, which held a final close on its €500m target in 2017

H2 acquires Optegra

Vendor of the ophthalmology company is Eight Roads, Fidelity International's private equity arm

Nordic Capital's Nordnet completes listing

IPO gives the company a market cap of SEK 24bn, compared with SEK 6.6bn at its take-private in 2017

Waterland's Athera makes three bolt-ons

Germany-based physiotherapy group has made 11 add-ons since Waterland's investment in 2019