UK buyout activity reaches post-crisis peak in 2017

Buyout activity in the UK private equity market soared in the first 11 months of 2017, reaching its highest levels in terms of volume and aggregate value since before the global financial crisis. Kenny Wastell reports

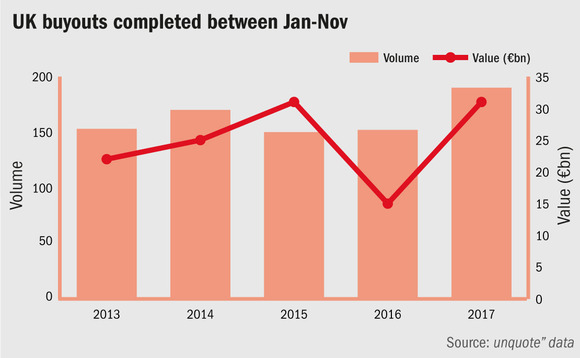

There were 183 buyouts in the UK between January and November 2017, according to unquote" data, up 22% compared with the 149 seen in the same period in 2016 and the highest dealflow since the 194 buyouts witnessed in 2008. More notable still, aggregate value reached £27.1bn, a 132% year-on-year increase from £11.7bn and the largest total since the £47.5bn aggregate seen in the first 11 months of 2007.

The small-cap and lower-mid-market spaces were particularly active, with a total of 160 transactions valued at less than £250m, up from 142 in 2016, and again marking a post-crisis peak. Looking specifically at buyouts valued at below £25m, there was a year-on-year increase from 47 in the first 11 months of 2016 to 69 in 2017. Indeed, the figure represents the highest activity in the small-cap space since 2012, when there were 76 deals.

The lower end of the market hasn't seen as much asset price inflation as the core mid-market, where entry multiples have been escalating" – David Hall, YFM Equity Partners

"The lower end of the market hasn't seen as much asset price inflation as the core mid-market, where entry multiples have been escalating," says YFM Equity Partners' managing director David Hall. "There are a number of factors behind that. In particular, the VCT route is no longer available to many businesses at the smaller end of the market, so that means more opportunities for institutional fund managers. And that is not going to change as we head into 2018."

There is, however, a consensus among numerous industry professionals who spoke to unquote" that 2017 has been a year of two halves. Indeed, while there were 111 buyouts in the first semester, the five-month period from July to November saw a notable drop in activity, with just 81 deals completed. This is moderately up on the 75 buyout transactions in the same period in 2016 and 72 in 2015, but equal to the number seen in 2014 and fewer than the 83 seen in 2013.

While investment activity was strong, the exit market was slightly less active in the first 11 months of the year. There were 185 divestments between January and November, a moderate year-on-year increase from 171 in 2016, but significantly down on the 251 in the first 11 months of 2015 and 281 in 2014.

Open for business

Nevertheless, there have been encouraging signs that the IPO market might have reopened this year, following a quiet 2016. The listing of Perwyn Private Equity-backed video games developer Sumo Digital in mid-December was the 10th private-equity-backed flotation in 2017, compared with just six in the whole of 2016, according to unquote" data. The figure still remains short of the 13 seen in 2015 and 32 witnessed in 2014, though a further listing – for VC-backed Fusion Antibodies – is expected by year-end. The signs point towards the IPO window remaining open as we move into 2018.

"There is a lot of interest from the public markets for assets that have predictable and recurring long-term revenue streams – technology and data companies with subscription models, for example," says Lyceum Capital partner Daniel Adler. "It doesn't surprise me that the IPO market has picked up."

Another key feature of the UK private equity landscape throughout 2017 was the number of first-time fundraisers in the market. At the end of October, FPE Capital became the ninth venture or private equity house to have closed a debut institutionally backed fund. By comparison, 2016 saw five such fund closes, with seven in 2015 and three in each of the preceding three years. Furthermore, a number of other firms, including former Electra Private Equity portfolio manager Epiris and female-led GP Vaultier7, are also on the road marketing their maiden vehicles.

Industry professionals give numerous reasons for this, with new LP entrants and increasing allocations widely cited. It is also, no doubt, a reflection of the wider buoyant fundraising landscape in the country. There were 57 final closes for fund managers headquartered in the UK during the first 11 months of 2017, accounting for aggregate commitments of £57.3bn. While the same period in 2016 also yielded 57 final closes, these totalled £53.1bn in commitments. In 2014 and 2015, there were 44 and 52 final closes respectively.

Sam Kay, head of investment funds at Travers Smith, tells unquote" he expects UK fundraising as a whole to continue strongly into 2018, as managers accelerate plans in order to insulate against regulatory uncertainty that will follow the UK's withdrawal from the EU in March 2019.

Indeed, while the backdrop of Brexit is yet to have a demonstrable negative effect on the private equity market, some industry insiders expect fund managers to become more nervous heading into the latter part of 2018. Furthermore, some private equity professionals tell unquote" they have concerns over the fragility of the minority Conservative government. Should there be another snap election in the 12 months ahead, the prospect of a Labour government, with more stringent tax policies, could lead to greater anxiety.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds