UK mid-market most affected by recession

The mid-market has suffered more during the double dip recession than other market segments, according to figures from unquoteт data.

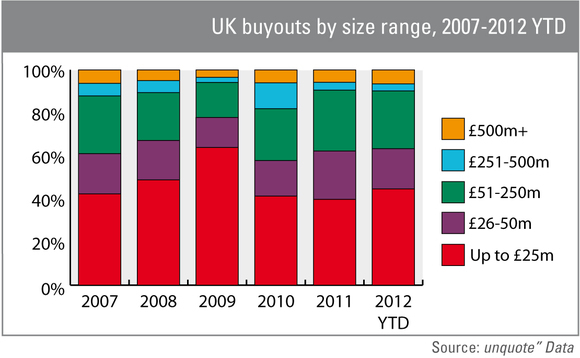

The latest numbers show both small-cap and large-cap buyouts represented a bigger proportion of the UK market in 2012.

Smaller buyouts worth £25m or less have accounted for almost 45% of all UK deals so far this year, up from 40% in 2011 and 41% in 2010. However, the actual number of smaller buyouts has remained remarkably stable, with 55 in each of the past three years. The falling total number of buyouts this year helped push up the proportion of small deals.

However, it is particularly surprising that large-cap deals worth more than £500m have also seen their share of the market increase. With many claiming leverage is difficult to obtain, the fact so many large, leverage-dependent transactions have taken place in 2012 would indicate that PE players are targeting strong large-cap opportunities with the kind of cashflow needed to convince cautious banks to take a risk.

In volume terms the large-cap market is still a relatively small proportion of UK deal activity, accounting for 6.5% in 2012 and 5.8% last year. Similarly to the small-cap segment, actual deal numbers have remained very stable, with 8 deals worth more than £500m in each of the last three years, and the falling buyout total has resulted in increased market share this year.

However, the mid-market as a whole is still the largest market segment, accounting for almost 49% of all UK buyouts, though this is down from 54% in 2011. Looking more closely, the upper mid-market from £250-500m is the most stable, representing 3.2% of deals in 2012 compared to 3.6% last year. However it is also the smallest segment with just four deals this year.

The lower mid-market has suffered the most during a difficult 2012, with 23 deals accounting for 18.7% of buyout investments, down from 22.5% a year ago.

It is, of course, worth bearing in mind that the UK's mid-market is still extremely resilient, and compared to the dire performance seen in most parts of Europe, it is a strong performer. Also, the return of recession in 2012 has not had nearly the same impact as the 2009 recession, and the UK is expected to remain well ahead of Europe's private equity pack in 2013.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds