UK buyout activity suffers deepest decline since 2009

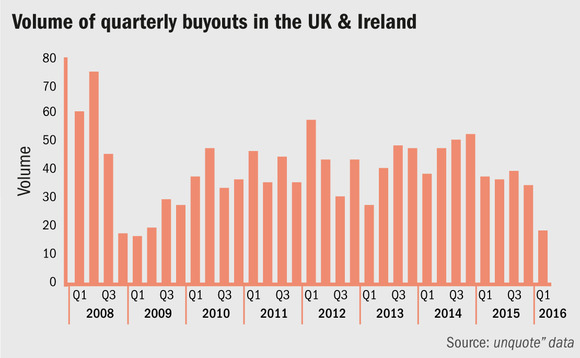

The volume of buyouts witnessed so far for the first quarter of 2016 is the lowest on record since 2009. Alice Murray charts the decline

With just less than two weeks to go until the end of the first quarter, twice as many deals need to take place for UK buyouts to reach the same volume as that seen in the previous quarter. With just 19 buyouts recorded so far this year, it will take some serious activity to match Q4's total of 35 deals.

If activity does not pick up over the coming days, deal volumes will match those seen in Q4 2008 and Q1 2009, when 18 and 17 buyouts took place, respectively.

Furthermore, when looking at early-stage and expansion deals, the first few weeks of 2016 have also been subdued, with just 66 investments recorded so far, down from 80 in the previous quarter. Again, without a significant flurry of activity over the next week or so, it could well be that even for these deals, which have typically hovered around the 100-120 level for the past five years or so, Q1 2016 could be the least active quarter on record since 2009.

Sick man of Europe

UK-based houses can take some relief in the knowledge that the slowdown of deals is not a UK-only problem – transaction numbers are low for the whole of Europe. Indeed, unquote" data has recorded 107 buyouts so far for the first quarter of 2016, down from 154 in the last quarter of 2015. The quietest period for buyouts since 2008 for all of Europe was Q1 2009, when there were just 69 transactions; however, by the end of that year quarterly deal volume had recovered to 123 and has been averaging around 150 per quarter ever since.

But it must also be noted that the UK buyout market typically accounts for around 50-60% of European activity. With just 18 deals recorded so far this quarter, the UK makes up for just 19% of Europe's total, lower than the 27 deals seen in France and 19 buyouts that took place in the Nordic region, and almost in line with southern Europe's 15 transactions.

One major difference between this quarter and those of late 2008 and early 2009 is aggregate value. Q1 2009 saw the lowest deal value, with combined deals totalling just £193m, but so far for this current period deals have reached an aggregate total of £1bn. While this is a far cry from the £5.5bn recorded in Q4 2015, and even more so from the £8.5bn put to work in Q4 2014, it is an important indicator of the current market situation.

High pricing continues to plague the buyout market. And while one might well assume that increased volatility in the public markets will start to impact pricing in the private market, high levels of competition for assets is ensuring that valuations remain strong.

Pricing pressure

One deal that has been in the works for several months now and illustrates this trend is Argus Media. The commodities pricing provider has attracted strong interest from private equity, with groups including Charterhouse Capital, Silverlake, Hellman & Friedman, Apax Partners, Cinven, Permira, TPG and Warburg Pincus reportedly submitting bids in the first round of the process.

However, with strong competition coming from trade bidders including Hearst Publishing, Verisk Analytics, the Chicago Mercantile Exchange, the Hong Kong Exchange and US-based Intercontinental Exchange, commentators believe the asset could go for as much as £1bn – representing an EBIDTA multiple of more than 20x. With Argus generating revenues of £124.4m and profits of £32.5m for the year ending June 2015, this is a clear example of sellers taking advantage of high levels of competition in the private market.

Furthermore, it has also been reported that the company's chair is demanding strict terms for potential buyers, outlining that whoever buys the 50% stake currently up for grabs must stay invested for at least seven years and put no more than four times leverage into the business.

Unfortunately, there seems to be little reason to believe activity will significantly pick up anytime soon. As the UK's referendum on its European membership looms, growing levels of uncertainty are likely to spook deal-doers over the next quarter as well.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds