Endless's Enact carves out Jost's Edbro

Endless has announced it is to acquire Edbro, the hydraulic cylinders business of Germany-based vehicle component producer Jost.

Jost acquired Edbro from Caravelle in November 2021. Jost said in a statement that it will continue to distribute Edbro's products to its customers, but will focus on growth opportunities in the transportation and agricultural commercial vehicle segment following the divestment.

Endless is investing in Edbro via its SME-focused Enact strategy, which was originally part of the Enterprise Investment Scheme (EIS). Endless has since raised additional capital for the strategy; the latest iteration, Enact Fund II, held a final close on £30m in June 2019. The fund makes investments of up to £10m, focusing on special situations and with additional funding available via Endless's other vehicles.

Edbro is the third investment from the Enact strategy in 2021, the GP said in a statement. Endless acquired TV production company Evolutions TV in January 2021, followed by decorating supplies producer Bartoline in March.

Company

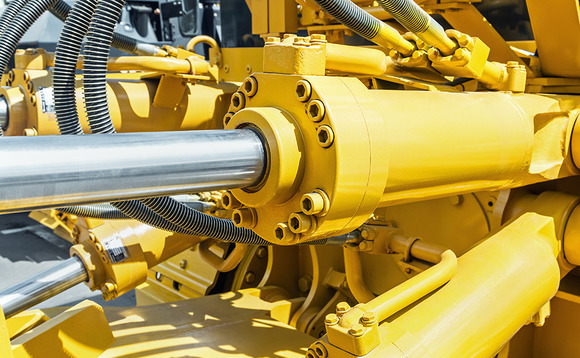

Founded in 1916 and headquartered in Bolton, Edbro produces hydraulic cylinders for trucks and trailers. Its product portfolio includes front-end, under-body and ejector cylinders, as well as waste handling equipment and customised hydraulics kits. According to its latest financial statements, Jost's UK operations generated 2019 revenues of £35.4m, compared with £37.6m in 2018. It reported a loss of £2.1m in 2019, versus £1.7m in 2018.

People

Endless – Richard Harrison (partner); John Stevens, Jon Duffy (associate directors); Luke Wolf (investment manager).

Advisers

Equity – Eversheds Sutherland, Elizabeth Tindall, James Finney, Edward Tompkin, Joanna Sowerby (legal); Tax Advisory Partnership, Russ Cahill (tax); Fox Lloyd Jones, Paul Fox (property due diligence); Vista, Peter Warburton, Jamie Oliver (insurance due diligence).

Vendor – Oaklins Smith & Williamson (corporate finance); White & Case (legal).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds