Carve-out

Carve-outs specialist Inspirit gears up for second fund

GP could aim to raise GBP 50m-GBP 100m for its next fund, Unquote reported previously

Sullivan Street carves out Tracerco from Johnson Matthey for GBP 55m

Fourth exit attempt for oil diagnostics arm garners 6.8x EBITDA sale multiple, family office Souter joins ticket

DAC Beachcroft hands exclusivity to Limerston for Claims Solution Group carve-out

UK-based sponsor Limerston Capital could close a deal in the coming weeks following a formal auction

GP Profile: Inspirit anticipates carve-outs uptick with fundraising on the horizon by year-end

Complex carve-outs specialist could raise around GBP 75m for its second fund with debut vehicle around 70% deployed

Inspirit Capital buys Capita's Modular People Solutions for GBP 21m

Carve-out deal is the seventh investment from the special situation GP's debut fund

PAI Partners to acquire IFF's Savory Solutions in USD 900m deal

GP is investing in the artificial aromas and flavours manufacturer via latest flagship fund

KKR buys Clinisupplies to build chronic care medical devices platform

GP installs former Atos CEO as chairman; deal is partial exit for Apax Partners' India-based Healthium

AnaCap carves out credit division

New business, Veld Capital, will raise new funds and also deploy via AnaCap's existing credit funds

Stirling Square buys Eurofins Digital Testing for EUR 220m

Mid-market GP is deploying 2020 Fun IV in primary carve-out from French laboratories company

HG-backed Visma to divest IT consulting unit to CVC

Sponsor will invest in the carve-out from the Norwegian business software and IT provider via Fund VIII

Advent and Lanxess form EUR 3.7bn polymers JV with Royal DSM carve-out

Buyers pay EUR 3.7bn for DEM; the new unit has sales of over EUR 3bn and EBITDA of EUR 500m

Trilantic to buy Kantar Public in carve-out deal

UK public policy advisory business will operate as an independent company following the carve-out from Bain Capital-backed Kantar Group

Clearlake, Motive to acquire BETA+ from LSEG for USD 1.1bn

GPs will use wealth management processing solutions provider as a buy-and-build platform and enter new high growth markets

Rubicon sells John Lawrie Metals to ArcelorMittal

The London-based GP invested in parent company John Lawrie Group in 2017

Aurelius buys CTD in carve-out from Saint Gobain

GP will own most of its stake in the ceramic tile firm via its EUR 360m European Opportunities fund

Merck pigments attracts PE interest in sale anticipation

The German conglomerate is in the early stages of deliberations about its options for the business and is yet to appoint a bank to handle a potential sale

EIM acquires Bonna Sabla from Bain-backed Consolis

Carve-out of the precast concrete manufacturer follows 20 years of private equity ownership

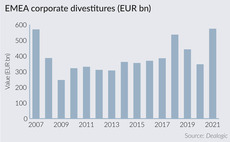

Split the difference – corporate divestitures set records

Firms have taken advantage of favourable conditions for M&A, including cash-rich and ever-bolder PE funds

Capiton buys Betonbau Group

GP is deploying equity via Capiton VI, which held a final close in November 2021 on EUR 504m

O3, Novum to acquire Gumtree UK, Motors.co.uk

Sale is required for Adevinta to obtain approval from the UK CMA to buy eBay Classifieds

CVC buys Unilever's tea business for EUR 4.5bn

European food and beverage buyouts are now set to reach EUR 13bn in 2021, according to Unquote Data

Aurelius buys McKesson UK in GBP 477m deal

Carve-out of McKesson UK includes LloydsPharmacy and is Aurelius's largest deal to date

Fidelium to acquire Benteler's Tønder and Louviers plants

Fidelium intends to establish the aluminum auto parts plants as an independent entity

Inflexion to acquire Sunovion Pharmaceuticals Europe

Inflexion's previous pharmaceutical sector investments include Rosemont Pharmaceuticals