In Profile: MML Capital

On the back of MML Capital's acquisition of French advisory group SVP in August, managing partner Bal Johal speaks to Denise Ko Genovese about why the GP still prides itself on a bespoke approach

"We don't really have any products to sell as we are not a vanilla private equity firm, so people come to us with an idea and we meet with them," says Bal Johal, managing partner of MML Capital. Indeed, the entry point into MML's assets has been varied, in keeping with one of the GP's straplines that one size only ever fits one.

"Either someone wants more equity in the business, they want to buy a competitor in the US, they need growth capital, or the current capital structure isn't helpful and they want to deleverage; the scenarios vary," says Johal.

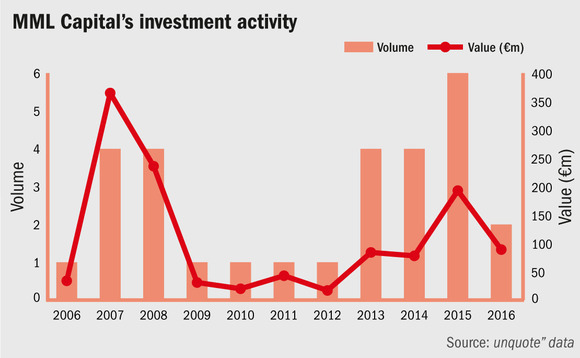

The GP has its roots in mezzanine financing – founded in 1988 as Mezzanine Management Limited – but transitioned into pure private equity by its fifth fund, which it raised in August 2009. Since 1988, MML has completed 103 deals.

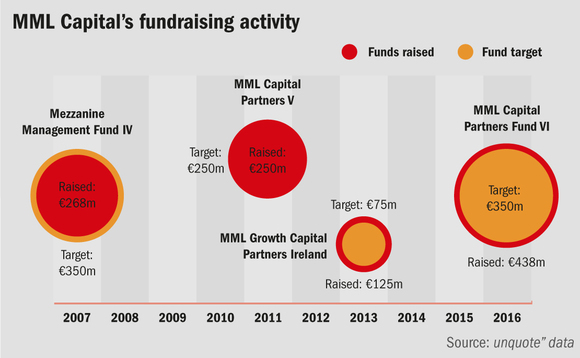

The last three funds are all focused on private equity investing. MML Capital Partners V raised £250m at final close in 2009 and is fully committed in 13 investments (one of which was a co-investment); MML Capital Partners Fund VI raised €438m at final close in March 2016, surpassing its €350m target. The vehicle is 35% deployed over seven investments (one of which is a co-investment).

The GP also has MML Growth Capital Partners Ireland, which was launched to back SMEs in Ireland at the invitation of the Irish government to help companies expand internationally. The fund exceeded its €75m target and closed on its €125m hard-cap in November 2013. Irish banks and the government were cornerstone investors.

Seizing the initiative

UK industrial laundry group Clean Linen, which MML acquired in December 2014, is an example of the house's receptivity to early-stage ideas and eagerness to craft bespoke deals. "We had a phone call from the finance director – he rang me via an accounting contact – and said he had called four private equity houses before us, not one had invited him in for a meeting and two didn't return his call," Johal recalls.

MML welcomed the opportunity and, within the space of two weeks, the GP had met the Clean Living team four times and the deal was all but wrapped up. "The idea was to create the highest quality [hotel linen laundry] service available and they asked if we could help them with that. They wanted to expand from the existing two sites and also buy some competitors, as well as open a new site that would cost an estimated £15m," explains Johal.

"The industry lends itself well to private equity as it is a service that benefits from being professionalised. You would never know but you need five sets of linen if you are a hotel – one on the bed, one in the cupboard, one being sent back for cleaning, one being sent to you and one in the wash – and if you don't get it right, you won't have linen on the bed and you'll lose income from not letting out the room. You don't want to get it wrong, and people will stick with a good service provider."

Since acquiring the laundry company in December 2014, they have already made two acquisitions – Watford Launderers and Cleaners in October 2015 and Paragon Laundry in January 2016 – and EBITDA has grown to double digit figures from roughly £4m on initial investment.

Rolling up the market

Another deal Johal cites is MML's 2013 investment in Irish-based ATA Group. On the other side of the sector spectrum from the tangible service of linen laundry, it makes tungsten burs – seemingly obscure but indispensable in certain industrial sectors.

"The only way to refine the edges of metal in aerospace appliance is to use these burs – you don't want to skimp on them. Everyone uses them and there are only three notable players in the world," Johal says. The GP invested €17.3m in order to fund the acquisition of US-based SGS Tools in order to create the global leader in tungsten burs.

MML also played a consolidation role in the market when it acquired Houston-based full service crane and rigging operator TNT Crane & Rigging. The GP made an additional four acquisitions for TNT following its initial investment in 2007 and subsequently sold it in 2011 having grown the fleet to more than 150 cranes servicing the Gulf Coast from its eight branches in Texas and Louisiana. "We acquired it in 2007 and exited 2012, a real buy-and-build as we felt there was the opportunity to roll up the companies," says Johal.

LP Base

Key People

• Bal Johal, managing partner, is based in the UK and has led a number of investments for MML such as The Regard Partnership, Clean Linen & Workwear, Instant Offices, Arena Group and Redmill Snack Foods. Prior to joining MML he was an investment director at 3i.

• Ian Wallis is a managing partner in MML's UK investment team. He has led transactions such as Baxter Story, Lomond Capital, Frontier Medex and ATA Group. Prior to joining MML, he spent seven years with 3i.

• Henry-Louis Merieux is a managing partner at MML, leading the firm's French investments. His transactions include Vulcanic, Coventya, Carré Blanc and Tournus Equipement. Prior to MML, he was in charge of debt structuring and restructuring and leverage finance at Deloitte Corporate Finance in France.

• Robert Davies leads investing activities in the US. Investments he has worked on include Waterbury Companies, IAC, TNT Crane & Rigging, Yonkers Racing Corporation and PaR Systems.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds