In Profile: Exponent Private Equity

On the back of Exponent Private Equity's recent acquisition of the Racing Post, Denise Ko Genovese talks to founding partner Chris Graham (pictured above) and managing partner Richard Lenane about the key traits of an Exponent deal

"We always look for a company that has in some way been constrained and unable to fulfil its potential," says Richard Lenane, managing partner of Exponent. "Companies where we can identify two or three significant changes to improve the business, things that are within our control and not linked to the prevailing economic climate," he says, adding that the GP's acquisition of Big Bus Tours in March 2015 is a good example of a typical deal. Exponent invests in UK-headquartered businesses with enterprise values between £75-350m.

The open-top bus sightseeing company was owned by a collection of families who had merged their individual companies over the years but were now facing strategy challenges, explains Lenane. The group was present in 86 cities and by far the leader in the open bus city tour market, but there was a need for someone to come in and take charge since the disparate management teams did not see eye to eye.

"We had the opportunity to create a clear competitive advantage by being big globally in a locally fragmented market and [incumbent] CEO Pat Waterman had a clear vision [to implement that]," says Lenane. "The company was relying a lot on selling on the street but only had a rudimentary online presence."

In response to this, the GP brought in a chief customer officer from Ebay to help, enhancing the company's presence on TripAdvisor and getting wifi onboard its buses – so customers could buy a ticket to the Tower of London as you passed by, for example.

There were lots of cross-selling opportunities that Exponent identified and began taking advantage of when the GP strategically sold a 15% stake in the company to Alton Tours owner Merlin Entertainments in February 2016.

Milestones

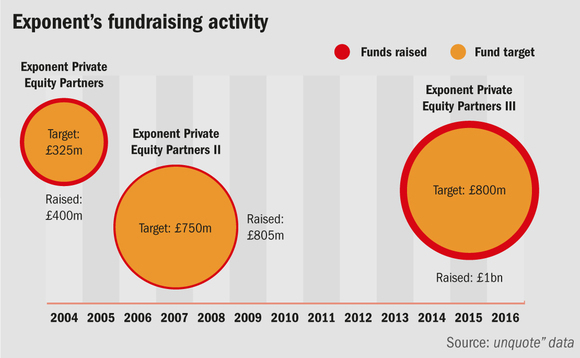

"It was a high-wire moment [when we set up in 2004] as we had a very good track record but it was the first time we were raising a fund so it was difficult," says founding partner Chris Graham. "We raised our first fund in 2004 and now we are on our third."

Exponent Private Equity Partners was launched in March 2004 and raised £400m, surpassing its £350m target. The vehicle is fully committed in 10 investments with a current 1.8-1.9x return and net IRR of 10%. Exponent Private Equity Partners II closed on £805m in May 2007, above the £750m target, and is fully committed in nine investments with a current 2.1x return multiple. Exponent Private Equity Partners III held a final close on £1bn in 2015, well above its £800m target. The fund has made five investments so far – Big Bus Tours, BBI, Wowcher, Racing Post and Photobox – amounting to 35% of the fund.

"Over the last five years co-investment has been a theme but appetite has definitely heightened in the last two. Ever since raising Fund III, the number of investors that hadn't said it was part of their programme two years before say it is very much on the table now," says Lenane. "In Fund II there was the opportunity to co-invest in every other deal but the balance was towards supply of co-investment opportunity rather than demand for it, whereas in Fund III every other investment is still a co-invest but satisfying demand is more of a challenge."

Click here to view a complete profile of Exponent I, Exponent II and Exponent III, including a comprehensive list of LPs and their individual commitments, on unquote" data

Consumer facing

It would be easy to think that Exponent has a clear strategic bias towards consumer-facing companies with the likes of Photobox, Wowcher, Radley, The Trainline, and Quorn in its portfolio history, with strong returns to boot.

Trainline was a white-label call centre for train tickets, which Exponent pushed towards a technology-led, digital service to customers. EBITDA on exit in 2015 was £38m from £14m at buy-in and the exit generated a 4x return for Fund I. Similarly, the GP made a 3.8x money return with Quorn when it sold the business for £500m in 2015, having grown EBITDA to £37m from £19m.

"[Quorn] was owned by Premier Foods – struggling under a weight of debt and starved of investment," says Lenane. "We took the business into the 21st century by modernising the brand; investing in advertising, marketing and capex; and building a team in the US."

For Exponent, it is all about bringing the right people into the business. The GP always brings in an operational chairperson from its network shortly after its initial investment. For Big Bus Tours, it brought in John Donaldson, who was previously at Thomas Cook, and for The Ambassador Theatre Group (ATG) it brought in former BBC director general Greg Dyke. "We try to recognise these people early on in the process and ask them to invest alongside us," says Lenane.

A career highlight for both Graham and Lenane was Exponent's investment in The Ambassador Theatre Group, making a 5.2x return on investment so far. "It was a highlight, as we did two simultaneous transactions – ATG and US corporate Live Nation's theatre business – when doing just one can normally be a mouthful. It was very satisfying," Graham says, adding that changes they implemented included bringing ticketing in-house, increasing occupancy, investing in productions and making it an international offering. With the GP at the helm, EBITDA grew to £35m from £18m.

Key People

• Chris Graham was one of the founding partners of Exponent in 2004. Since then, he has been involved in the TSL, Gorkana Group, Ambassador Theatre Group, Quorn Foods, Immediate Media, Loch Lomond Group, BBI Group and Wowcher transactions.

• Richard Lenane, managing partner, joined Exponent in January 2005 and has been involved in the TSL, Group GTI, Gorkana Group, Ambassador Theatre Group, Fintrax Group, HSS Hire, Big Bus Tours and Racing Post transactions.

• Tom Sweet-Escott, founding partner, has been with the GP since 2004. Since then, he has been involved with Trainline, V Group, Lowell Group, HSS Hire and Photobox Group.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds