In Profile: Electra Partners

Electra Partners has made a number of divestments over the past 12 months, though dealflow has slowed since it received termination notice from listed vehicle Electra Private Equity. Kenny Wastell explores the firmтs performance and its future options

The past year has been a particularly turbulent period for mid-market buyout house Electra Partners. In May 2016, the firm was given 12 months' notice that its contract to be the investment portfolio manager of listed vehicle Electra Private Equity (EPE) was to be terminated. The announcement came as part of an ongoing strategic review set in motion by EPE's activist investor Edward Bramson in January.

Electra managing partner Alex Fortescue said at the time the GP was proud of its "exceptional performance record", adding that the termination was both "a surprise and a disappointment". EPE said in a statement it would explore "a range of options including retaining the services of Electra Partners as investment manager under a mutually acceptable agreement".

However, in October the listed LP concluded the first phase of its review, announcing it is to move away from its status as a listed investment trust to a corporate structure. The LP said at the time that the move will enable it to make savings of £25m, including the "elimination of carried interest", calling into serious question the likelihood of a continuing relationship between the two parties.

Electra continues to investigate alternative options for the future. At the time of EPE's termination notice, the GP cited its "established relationships with a number of investors" and said it had "received numerous expressions of interest from others".

Ramping up divestments

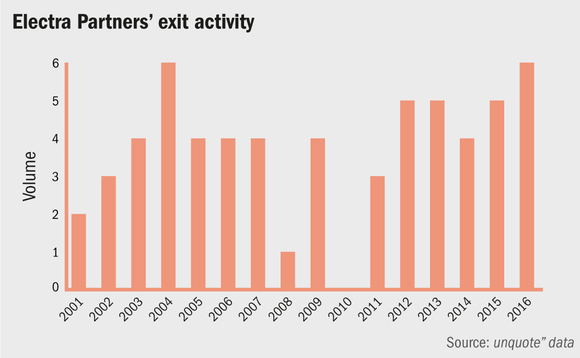

Since Alex Fortescue joined Electra as chief investment officer in 2011 – and was subsequently promoted to managing partner – the firm has invested in the region of £1.4bn and returned around £2.4bn with a net IRR of 20%. Of this total, around £1bn has been realised since September 2015. Electra has been particularly active on the exit front over the past 18 months, as unquote" data underlines.

Between May 2015 and October 2016, the firm made 10 exits or partial exits, compared with six in the preceding 18-month period. This divestment activity is largely a consequence of high levels of deal activity in the 2012-2014 period, unquote" understands. However, it is also notable that some of its recent divestments have come after particularly short holding periods. Despite these short tenures, the assets have nevertheless delivered impressive returns for the GP.

Electra generated £153m from the IPO of tenpin bowling operator Hollywood Bowl in September 2016, just two years after its initial investment. The partial sale represented a 3.9x total return – taking into account its remaining stake in the business – equivalent to an IRR of more than 90%. Similarly, the sale of fund administration business Elian to Intertrust Group for £435m in June also came after a two-year holding period, and generated a 2.6x return and an IRR of 50%. The GP implemented a buy-and-build growth strategy for the business that saw it acquiring SFM Europe and Allied Trust in 2015, which extended its international reach into 13 territories.

Other exits since the start of 2016 include the €81m divestment of fine art materials business Daler-Rowney to Fila Group in February; the sale of sausage casing producer Kalle to Clayton Dubilier & Rice in April; and most recently the £139m IPO of Premier Asset Management in October.

Dealflow slows amid uncertainty

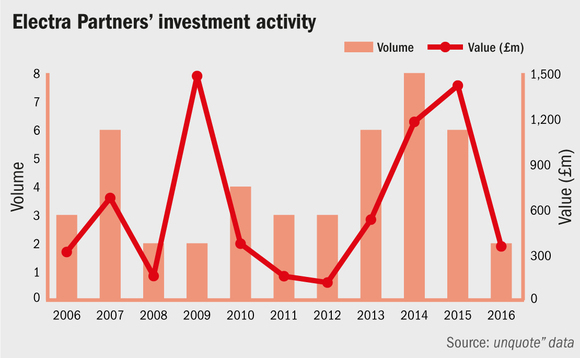

Electra adopts a number of approaches to deploying capital, with a particular focus on co-investments, loan-to-own debt investments and buyouts – where geographic expansion, buy-and-build platforms and market repositioning have been the predominant strategies. Such deals account for £1bn of the total £1.4bn invested since 2011, delivering gross IRR of 36% and net IRR of 27%. However the firm has also historically made performing debt deals, as well as being active in the secondaries market.

Electra invests primarily in the industrial goods and services sector, accounting for 33% of dealflow since 2007 according to unquote" data, with travel and leisure accounting for 21%, retail accounting for 16% and financial services accounting for 12%.

Geographically, the firm focuses on investments across the UK, though it retains some legacy-related exposure to other European countries. Of the 43 deals completed since 2007, 38 have been for British companies, with four investments in France – PhotoBox, Allflex, Labco and Locatel – and Kalle marking its only German deal.

Unsurprisingly, given the developments in its relationship with EPE, the GP has been relatively quiet on the dealmaking front in 2016. Indeed, the GP has announced just two deals since the start of the year; joining Patron Capital in the £325m carve out of Retirement Bridge Group from parent company Grainger in January; and funding the merger of Axio's intellectual property division TechInsights with Chipworks.

By comparison, in the four years prior to 2016 Electra averaged six deals per year. However, it is understood low dealflow in the first half of this year can also be partly attributed to a wider market slowdown in the lead-up to the UK's referendum over its membership of the European Union.

Electra is undoubtedly set to undergo a transitional phase, as its contract to be EPE's investment portfolio manager lapses.

Key people

• Alex Fortescue, managing partner, chairs the firm's management committee and is a member of its investment committee. He joined Electra from Apax Partners as chief investment partner in 2011 and was promoted to managing partner in January 2016. He has seats on the boards of portfolio companies Axio Data, Parkdean Resorts, Davies, Hotter Shoes and Knight Square.

• Bill Priestley, chief investment partner, leads the investment team and sits on the investment committee. He joined the firm in 2014, leaving his role as managing director at LGV Capital. Priestley has seats on the board at portfolio companies Hollywood Bowl, Innovia and TGI Fridays.

• Alex Cooper-Evans, partner, oversees investor and public relations activities at Electra and sits on the investment committee. He joined the firm in 2006 and was involved in the fundraising process for Electra Partners Club 2007. He has seats on the board at Axio Data and Knight Square.

• Charles Elkington, partner, sits on the investment committee. He joined the GP in 2005, leaving his role as director at Deloitte. Elkington has seats on the boards at portfolio companies Audiotonix and Sentinel Performance Solutions.

• Chris Hanna, partner, is part of Electra's investment committee. He joined the firm in 2011 from Phoenix Equity Partners and has a seat on the board at portfolio company Treetops Nurseries.

• Stephen Ozin, partner, is Electra's chief financial officer and is also responsible for group compliance and the company secretarial functions. Ozin joined Electra in 1990, having previously worked for Coopers & Lybrand Deloitte. He sits on the investment committee and has worked on deals including property holding company Noumena and transportation company Rio Trens.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds