In Profile: Graphite Capital

Having been active for more than three decades, Graphite Capital has had to adapt its investment approach to a changing consumer landscape. Denise Ko Genovese discusses the firm's track record and fundraising activity with senior partners Andy Gray and Markus Golser

"The biggest change in the last 20 years has been the professionalisation of every part of the [buyout] process," says Andy Gray, senior partner at Graphite Capital. "Before we did everything ourselves but now it has all become compartmentalised."

"If you just participate in broad auction processes, you may be fine, but you won't be a top performer," says Markus Golser, senior partner. "It is necessary to think outside the box, to circumvent the system and be creative." Golser points to the development of London-focused housebuilder London Square, which Graphite founded in April 2010, and on which it generated 30% IRR over three years. "We created the investment opportunity ourselves."

On exit in 2014, London Square had completed and sold three developments, which consisted of 116 units and generated £84m in cash proceeds, with a further eight developments in the pipeline. The sale to Ares Management generated a money multiple of 2x cost.

Fund milestones

Graphite is a UK-centric private equity house investing £25-75m equity cheques in companies with a typical EV of between £35-140m. Since inception in 1981, the GP has made more than 300 investments.

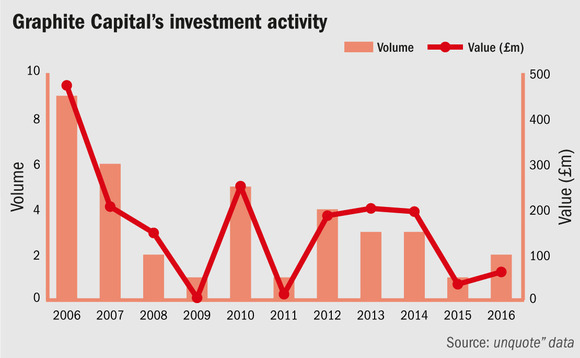

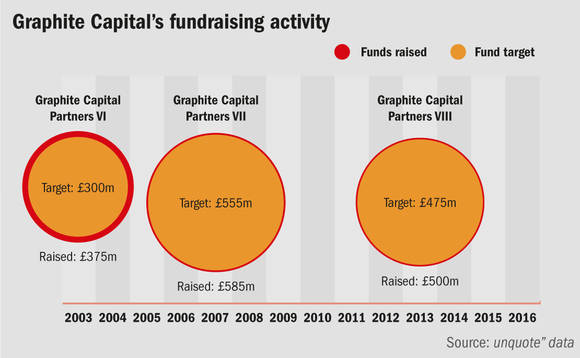

The firm is currently investing from Graphite Capital Partners VIII which closed on £500m in September 2013, above its £475m target (including a £50m co-investment pool). The fund has around £165m of dry powder remaining since two-thirds has been deployed over the past three years across six investments, comprising Beck & Pollitzer, Aero Technics, Human Capital Investment Group, ICR Integrity, City and Country Healthcare Group and New World Trading Company. The GP envisages starting to raise Fund IX within the next 12-18 months.

The biggest change in the last 20 years has been the professionalisation of every part of the [buyout] process. Before we did everything ourselves but now it has all become compartmentalised" – Andy Gray, Graphite Capital

Its other most recent funds include Graphite Fund VII which raised £585m at close in May 2007 and is fully invested across 11 investments. Six have been exited – AMS, Education Personnel, Kurt Geiger, London Square, NFA and Willowbrook – and the fund is on track to make a 2.7x return. Graphite Fund VI raised £375m at close in April 2003 above the £300m target and Graphite Capital Partners V raised £183m at close in August 1999.

The GP previously managed Graphite Enterprise Trust, which was sold to ICG at the end of 2015. At the time of the sale, managing partner Rod Richards said that over its 30 years as manager, the £23m raised in the early 1980s had increased to £681m, of which £180m was returned in cash, representing 29x the amount subscribed.

Restaurants and Retail

"We are a generalist house but we have had consistent success in many sectors including retail and leisure," says Gray.

Over the years many high street retail and consumer names have passed through Graphite's hands including Maplin Electronics, shoe company Kurt Geiger and womenswear brand Jane Norman. But by its own admission the GP is currently less active in product retail, which is increasingly susceptible to competition from online vendors and other multi-channel retail developments. Its buyout of after-school tuition services group Explore Learning in August 2012 is indicative of how the GP has adapted its sector focus.

"When we bought Maplin [in 2001], you couldn't buy what you can now on the internet, like the parts to build your own computer, so you had to go to Maplin," says Gray. "It was a turnaround story though, as we had to beg for debt at the time, but ended up making 10x money."

Casual dining chain Wagamama, founded in the 1990s, was another example of a turnaround deal made by Graphite. "When we came to it, it was a rescue deal," Gray says. "We had to work out what we had; they had overspent on the new location. In some ways it was great as we didn't know what we had. It was experimental in some ways, but we ended up rolling out the concept in Australia and Holland."

The GP grew the number of restaurants to 70 in the UK, with additional international locations, from an initial two. Turnover grew to more than £110m from £2.5m on entry and operating profit to £20m from £400,000. The GP sold a majority stake to Lion Capital in 2005 and the remainder to Duke Street in 2011, generating a multiple of 12.8x investment return and IRR of 37%.

Graphite later invested in high-end restaurant operator Corbin & King, as well as steakhouse Hawksmoor. More recently, it acquired pub and restaurant business New World Trading Company from LDC for £50m in June this year.

Bursary Fund

Graphite also runs a £1m bursary fund alongside charity Buttle UK, which is managed by senior partner Simon ffitch and is to be distributed over a 10-year period. The fund is designed to help children and young people across the UK whose safety, health or development are at risk. It supports young adults between the ages of 16 and 20 who do not have the support of parents or carers by providing grants of up to £2,000. The fund aims to help people back into employment, education or training, while establishing a new home.

Key People

• Rod Richards, managing partner, joined in 1986. In 2001 he led the management buyout of Graphite from the Foreign & Colonial Group. He previously worked for McKinsey & Co and for Bell & Howell.

• Andy Gray, senior partner, joined in 1992, prior to which he worked in private equity for Morgan Grenfell Development Capital.

• Markus Golser, senior partner, joined Graphite in 1997. Prior to this he worked as a management consultant with Bain & Company in Paris and London.

• Mike Tilbury, senior partner, joined in 2000. He was previously in corporate finance with Deutsche Bank, and NatWest Securities and NatWest Ventures.

• Simon ffitch, senior partner, joined in 1992. He previously worked on equity and mezzanine transactions at Hill Samuel Development Capital. He also worked at LEK Consulting.

• Mike Innes, senior partner, joined in 2005. He started his career as a solicitor with Clifford Chance and then founded an internet-based legal recruitment consultancy before joining Bank of Scotland's integrated finance team.

• Stephen Cavell, senior partner, joined in 1993 and is head of investor relations at Graphite. Previously he worked at Baring Brothers Corporate Finance and Barclays Bank Structured Finance.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds