In Profile: Alcuin Capital

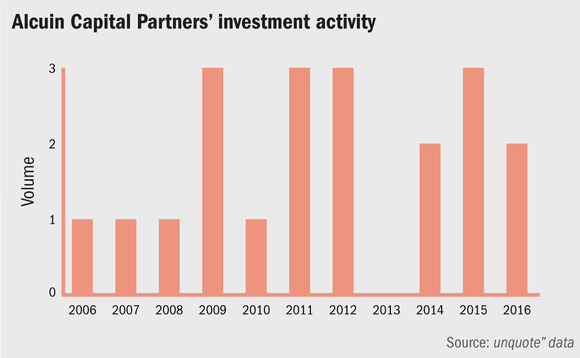

With another deal expected to close in the coming weeks, Alcuin Capital Partners' fourth fund will likely be up to 30% deployed by year-end. Denise Ko Genovese speaks to managing partner Adrian Lurie about the firm's evolution

Lower-mid-market private equity house Alcuin Capital began life in 2007 when it raised its first fund of £10m from cornerstone investors Alliance Trust, Celox and Parish Capital, and subsequently another £10m for Fund II.

According to Alcuin Capital Partners managing partner Adrian Lurie: "While the partners had been working and doing deals together for many years previously, both these funds gave us the opportunity to make several investments as the Alcuin team, which then enabled us to springboard into Fund III – our first 10-year fund – with £100m of total commitments."

Alcuin Capital III made a first close on £81m in January 2011 and a final close on £100m in November 2011. It is now fully allocated over 10 investments (Agrivert, Tasker, Osprey, Krispy Kreme, AVMI, Domus, Neville Johnson, Salt Yard, AMI and The Groucho Club).

We had 100% re-ups for funds III and IV and took just three new LPs on board" – Adrian Lurie, Alcuin Capital Partners

In July 2015, Alcuin IV closed on its £150m hard-cap. The original target had been £120m and there have been four investments so far – Deluxe, Lorega, Dovetail and Air Charter Services. With another deal expected to close in the coming weeks, the fund will likely be up to 30% deployed by year-end, says Lurie.

"We had 100% re-ups for funds III and IV and took just three new LPs on board," says Lurie. "The demographic was skewed towards European and US insurance companies as well as private endowments and high-net-worth individuals."

Click here to view a complete profile of Alcuin Capital Partners III and IV, including a comprehensive list of LPs and their individual commitments, on unquote" data

Solid as a rock

"Small, growing companies, especially entrepreneurial ones, will continue to traverse the lower-mid-market and will potentially require capital for various reasons on their journey, despite the prevailing economic climate," says Lurie, who advocates stability in the post-Brexit private equity world. "While there is clearly scope for caution, particularly regarding businesses in more cyclically exposed sectors, it is still necessary to have a measured long-term stance."

Our deal volumes are driven more by the availability of good individual opportunities than the cycle in general" – Adrian Lurie, Alcuin Capital Partners

The GP typically uses intermediaries to source deals since, by its own admission, it is too small to have a fully-fledged origination team. Having said that, the lower-mid-market space in which Alcuin operates is not that highly mediated, according to Lurie. "Auctions and more highly intermediated sale processes have tended to be more a feature of larger deals. While we do see processes and they can work well for the right situations, they don't suit all deals and often don't work well for smaller deals, where the requirements of the vendors, management and business can be complex.

"Since we don't rely on just one type of investment, we tend to find that our deal volumes are driven more by the availability of good individual opportunities than the cycle in general."

Although Alcuin's fund sizes have grown from £10m to £150m over the space of 10 years, the GP's investment thesis has remained the same. Alcuin invests in the UK lower-mid-market, prioritising companies with a good service offering but those that do not necessarily have scale. Typically these are companies with £1-5m EBITDA with clear room to grow. The Alcuin ticket size is usually £2-15m, which it invests in management buyouts, buy-ins, growth capital deals and recaps.

Loan ranger

As to the dramatic increase in the number of debt providers in recent years, Lurie emphasises there still is not a huge availability of debt in the lower-mid-market space. "This has generally suited us as we tend to use debt sparingly, preferring to focus on identifying investment opportunities with good organic growth prospects."

But Alcuin does use debt financing on occasion, using the incumbent lender HSBC on its Groucho Club investment and Santander on Krispy Kreme, as well as alternative forms of capital such as asset-based lending from Centric on its Domus investment, or unitranche lending from Indigo on AVMI.

"We originally used unitranche lending from Indigo on AVMI, where we knew we were likely to need further follow-on capital to make a meaningful acquisition shortly after making the original investment. It was a great example of where working with a lending fund made sense as they were able to provide a greater certainty of funding and flexibility of terms, which suited us well at the time," says Lurie.

Although it could be argued that Alcuin has a consumer bias when it comes to picking investments, the GP insists it is sector agnostic. Indeed, the sectors of its 2016 investments are diverse, including growth capital investments in simulation games developer Dovetail Games and private jet broker Air Charter Service last month, and claims assistance and loss recovery insurance group Lorega in March. But Alcuin has also previously taken ownership stakes in prominent brands such as Krispy Kreme and Caffè Nero.

Through Fund III, the GP backed the £25m MBO of Krispy Kreme UK in October 2011 from Cheshire & Kent, an investment group run by three US entrepreneurs, and exited the company last month. Though it had been slated for a flotation on the London Stock Exchange, it was sold back to its original US parent company at the eleventh hour. On exit, the company was generating roughly £13.7m EBITDA (as per 31 January 2016 year-end accounts) compared to £3.4m on entry (as per 31 January 2011 year-end accounts).

"It was a good example of how we as an investor worked together closely with the management team to identify and create growth and value," says Lurie. "The company has great financial characteristics – having grown substantially with strong cash generation and great returns on investment, it was an excellent candidate for IPO. However, we ultimately received an offer from the US brand owner that made sense."

Alcuin was also an early private equity investor in Caffè Nero in the late 1990s and was subsequently invited to support the team and business via a modest investment when it was taken private by its current owners in 2007.

The private equity house typically sells its investments to trade buyers. The only secondary buyout it has transacted was selling IT management services group Adapt to fellow GP Lyceum Capital in September 2011.

• Mark Storey, founding partner, previously worked for Banc Boston Capital before setting up Alcuin in 2004.

• Grace Henderson-Londono, founding partner, previously worked for Banc Boston Capital and Baring Private Equity prior to co-founding Alcuin in 2004.

• Adrian Lurie, managing partner, previously worked at Indigo Capital before joining Alcuin in 2011.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds