GP Profile: Bain Capital

Bain Capital is currently investing from its $3.5bn fourth Europe-specific fund, though the GP also makes investments on the continent with capital drawn from its global vehicle. Denise Ko Genovese takes an in-depth look at the firm's activity

The global operations of Bain Capital currently have a bumper $75bn in assets under management. Around half – $38bn – is in its private equity business ($3.9bn in venture capital), with $30.7bn in debt capital and $3.5bn in public equity capital (as of November 2016).

Private equity has been the cornerstone of the business since starting out in 1984, when Bain Capital was born as an offshoot of consulting firm Bain & Company, though no links remain today.

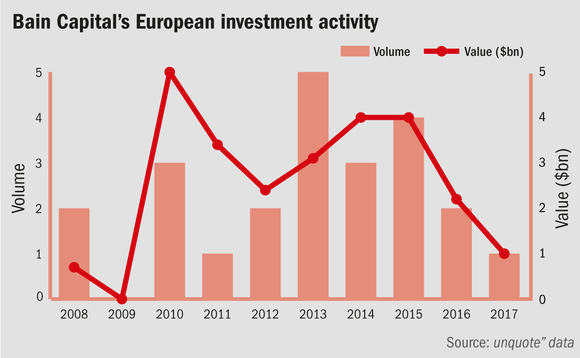

Looking specifically at Europe, Bain is currently investing from its latest fund Europe IV, which was oversubscribed and raised $3.5bn – against a $2.5bn target – at final close in 2014.

Its predecessor fund, Bain Europe III, raised $3.5bn against a $2.5bn target in 2008 and, in the same year, global vehicle Bain Fund X raised $7.8bn compared to a $3.9bn target. These were not simultaneous fundraises.

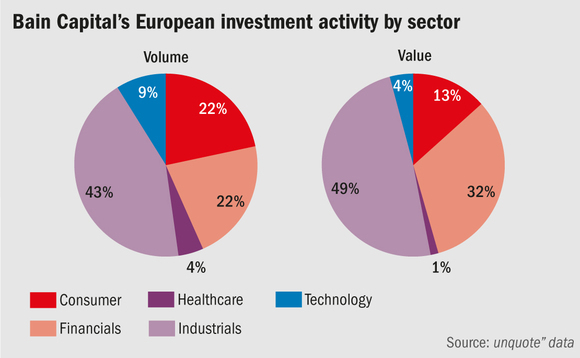

Bain is open to co-investments – in fact there is a list of LPs that rotates when the opportunity arises. It is also not averse to making acquisitions alongside other private equity houses such as the recent investments in Concardis with Advent, and ICBPI with Advent and Clessidra.

Global firepower

Although the funds are separate, there have been instances where the global fund has invested alongside its European counterpart. UK headquartered payment services group Worldpay is an example, as well as comparable Danish company Nets.

And the same goes for its debt fund. Though very separate, Bain on occasion provides credit from its debt fund to support its equity investments, such as the recent acquisition of ICBPI and Stefi in Italy, where Bain provided unitranche together with two other debt providers.

The $33.5bn credit under management consists of liquid, structured finance, private debt/mid-market and distressed debt, such as buying non-performing loan portfolios from European banks in Spain, Ireland, Italy and Greece. Occasionally the credit business has ended up as owner, with Towergate and Biffa being the most recent examples.

In the last 12 months, acquisitions include Italian tyre wholesaler Fintyre in March; German payment services group Concardis (not yet closed); business process outsourcing company MSXI in January; and Consolis from LBO France in December 2016 (not yet closed). Exits include floating Maison du Monde in May 2016; the sale of Worldpay in April 2016; IPO of Nets together with joint owners Advent and ATP; the sale of FTE Automotive to Valeo in June 2016; and the sale of Brakes in February 2016.

Key People

• John Connaughton is co-managing partner of Bain Capital and global head of Bain Capital Private Equity, as well as the firm's healthcare vertical. He joined in 1989 and has been a managing director since 1997. Connaughton is based in Boston.

• Jonathan Lavine is managing partner and chief investment officer at Bain Capital Credit.

There are an additional 10 managing directors in London.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds