GP Profile: Permira

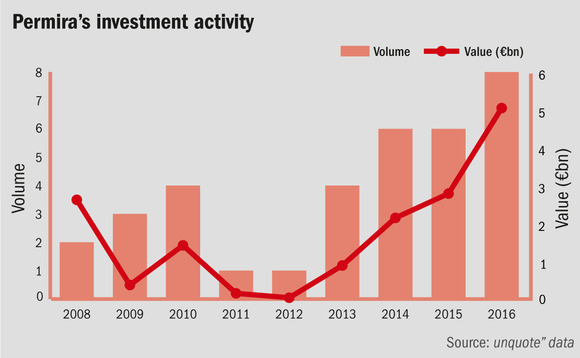

Permira closed its sixth fund on €7.5bn in January 2017, and has made three investments from it to date. Denise Ko Genovese takes a snapshot of the 30-year old private equity stalwart

Permira started life under the Schroder Ventures brand in 1985 and raised its first pan-European fund in 1997. It subsequently rebranded to Permira in 2001. To date it has committed €32bn of capital and invested in more than 200 companies.

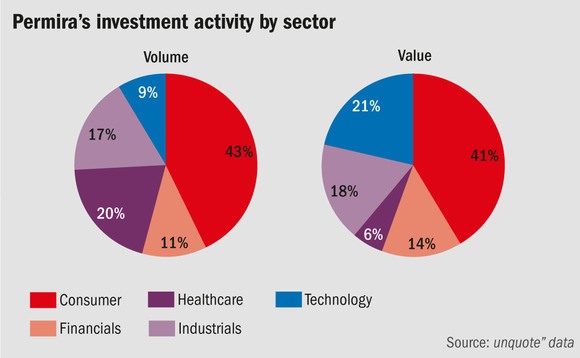

The private equity house invests in five sectors – consumer, financial services, healthcare, industrials and technology – with consumer the biggest sector by value and volume, according to unquote" data.

Current consumer companies in its portfolio include Italian petcare retail chain Arcaplant (bought in 2016) and UK British footware brand Dr Martens (acquired in 2014). Realised investments within the space include German fashion brand Hugo Boss and UK highstreet retailer New Look. Permira acquired Hugo Boss in 2007 with capital drawn from Permira IV and exited in 2015, making a 2.3x return on investment. EBITDA more than doubled from €275m on acquisition to €591m in 2014, against a 60% increase in sales to €2.6bn. The GP also made a 4.4x return on its investment in New Look after 11 years at the helm.

The second biggest sector by value for Permira is technology, according to unquote" data. The GP's current deals include German provider of integrated software solutions P&I (2016) and German provider of secure remote support software Teamviewer (2014).

Many of its technology investments are in the US, where it has an office in Silicon Valley. These include the 2015 team-up with the Canada Pension Plan Investment Board for a $5.3bn takeover of software group Informatica Corp.

Fundraising

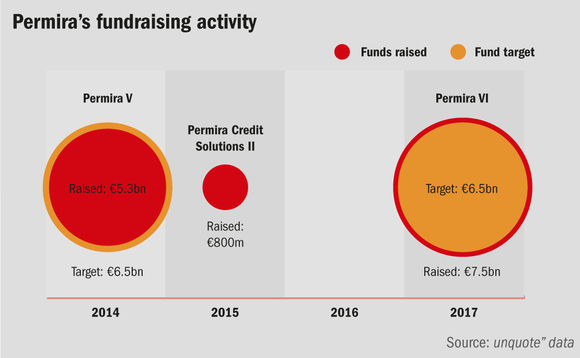

Permira VI was launched in February 2016, with an initial target of €6.5bn, and held a first close in July of that year on €6.3bn. The fund closed on €7.5bn (at the hard-cap of €7.25bn plus GP commitments). The ticket range is €250m-600m in companies with an EV of between €500m-3bn.

The GP's previous fund, Permira V, raised €5.3bn at final close in 2014 and completed its latest investment in October 2016, purchasing Hong Kong-based Tricor from The Bank of East Asia and NWS Holdings. Since 1997, Permira's previous five funds have invested a total of €21.4bn. As of 31 December 2016, these investments had generated a net IRR of 23%.

Permira VI has made three investments to date, buying out Polish online marketplace Allegro alongside Cinven and Mid Europa, acquiring German fashion retailer Schustermann & Borenstein in a secondary buyout, and taking a minority stake in fund and corporate services provider Alter Domus. A total of €1bn has been committed to date.

Diversified

Permira Debt Managers was established in 2007. David Hirschmann was recruited as head of private credit in June 2015 after Dan Hatcher was hired earlier that year to lead UK origination. The credit platform now has two strategies – direct lending (currently with AUM of €2.1bn) and structured credit (with AUM of €625m).

There are two direct lending funds to date: PCS1, which backed 72 companies and is now fully realised; and PCS2, which raised €800m at final close in 2015 and has backed more than 28 companies so far.

PCS3 is targeting €1bn, with a first close held in December 2016 at €900m.

The most recent completed fundraise for the credit arm was the €274m collateralised loan obligations (CLO) fund Permira Sigma IV in September 2016. The new fund will make long-term investments in the primary and secondary CLO markets. It will specifically target the most junior elements of the CLO capital structure and has already made 17 investments to date. The three CLO funds raised between 2010-2012 are fully invested.

Key People

• Kurt Björklund, co-managing partner, joined Permira in 1996. He serves on the board and the executive committee, and chairs the investment committee. He joined the London office in 1996 and became a partner in 2001. From 2003-2008, Björklund was responsible for the Nordic office. Prior to Permira, he was at Boston Consulting Group in Stockholm.

• Tom Lister, co-managing partner, joined Permira in 2005 to build the North America business. He serves on the board, the executive committee and the investment committee, and in June 2011 became the fund minder of Permira VI, Permira V, Permira IV, Permira III, Permira Europe II and Permira Europe I. Prior to joining, Lister was at the New York buyout firm Forstmann Little & Co.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds