European SBOs reach record levels in first three quarters

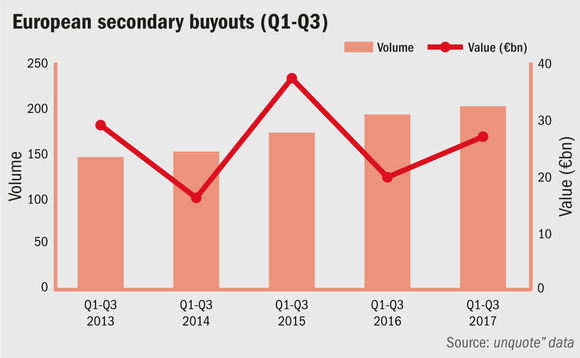

Secondary buyout volume in the European private equity market in 2017 reached its highest ever for the first three quarters of a year, amid a wider uptick in buy-side PE activity.

The European market saw 202 pass-the-parcel deals between Q1 and Q3, surpassing the peak of 200 seen in the first three quarters of 2007, according to unquote" data. The figure was also 5% up on the 193 such deals witnessed in Q1-Q3 2016.

Notable deals involving private equity vendors include Cinven's £2.4bn sale of CPA Global to Leonard Green & Partners, PAI Partners' €2bn sale of DomusVi to ICG, and PAI's €1.85bn sale of Cerba Healtchare to Partners Group and Canadian pension fund Public Sector Pensions Investments.

There was also a 36% year-on-year increase in aggregate value terms for SBOs between January and September 2017, with the total deal value reaching €26.97bn, compared with €19.81bn in the same period in 2016. However, the figure is some way below the €37.26bn aggregate value in the first three quarters of 2015, a year that saw a number of mega-deals in the space. Indeed the first three quarters of 2015 saw the €3.5bn Allianz Capital Partners-led acquisition of Autobahn Tank & Rast from Terra Firma, CVC's €2.8bn acquisition of Douglas from Advent International, and Brait Private Equity's £1.9bn acquisition of New Look from Apax Partners and Permira.

Wider uptick

Despite the swell in volume, SBOs are not necessarily moving the needle as a proportion of buyout activity, reflecting a highly active wider market on the buy-side for private equity. Fund managers accounted for just 33.3% of vendors in PE-backed buyouts in the first three quarters, down from 35.8% in 2016, 38.2% in 2015 and 35.9% in 2013. Across the last five years, only 2014 saw SBOs account for a lower percentage, with SBOs accounting for 32.5% of all buyout activity.

Meanwhile, looking at exit routes for GPs, SBOs accounted for 32.3% of all exit dealflow between January to September 2017, exactly matching the 32.3% seen in Q1-Q3 2016, but considerably up on the 23.4% in the same period in 2015, 20.2% in 2014 and 16.5% in 2013.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds