LP Profile: Pantheon

Since the start of 2018, Pantheon has expanded its international investment committee and appointed two new principals in its European- and US-based teams respectively. The LP's managing partner, Paul Ward, talks to Unquote about the resurgence of separate managed accounts and shying away from first-time funds

Pantheon started out life 35 years ago in London, but within five years had opened an office in San Francisco.

"[35 years ago] it was essentially a private equity investment firm with separate account clients, where we were providing solutions to specific portfolio issues certain investors had," says Pantheon managing partner Paul Ward. "We then expanded – as did the market – and funds-of-funds emerged, as did investing through primaries, secondaries and co-investments."

Though the team had been committing capital to opportunities in credit and infrastructure for many years, it was only nine years ago that the firm expanded into offering dedicated infrastructure and real assets strategies.

"A while back everything was just called private equity and there wasn't much differentiation, but definitions have changed now," says Ward. "It's a more complex ecosystem today than it was in the early 1980s."

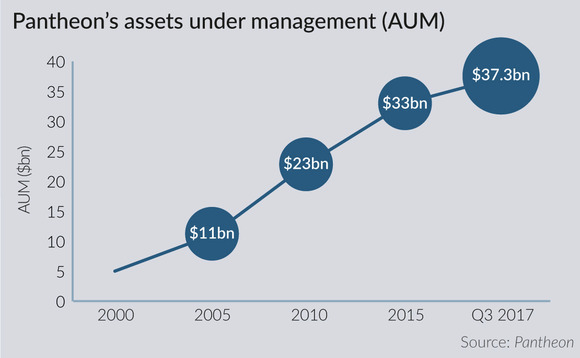

As of today, Pantheon offers three principal different asset classes – equity; infrastructure; and real assets, through primary, secondaries and co-investment programmes. As of September 2017, Pantheon had $37.3bn in assets under management, of which $28.4bn was in PE, $3.6bn in infrastructure, and $1.8bn in real assets – the remainder being allocated to other discretionary strategies or subject to a reporting mandate. Infrastructure and real assets have both become strong growth areas within the private markets.

The firm has approximately 250 staff, more than 75 of whom are investment professionals and two thirds of whom are based in London. Saying that, 50% of money is invested in the US, affirming its stance as a global fund. As of today there are six offices in London, San Francisco, Hong Kong, New York, Seoul and Bogotá.

"In a sense, 35 years on, we have come full circle: as our investors search for particular or precise portfolio solutions, we are going back to our roots where we're seeing increased demand for separate managed accounts," says Ward, adding that the trend has really materialised since the global financial crisis. "Funds-of-funds do a good job, but as the market has matured, some investors – often the larger ones or those who have been investing in private markets for many years – have themselves diversified how they invest, adding separate accounts to focus on certain areas, or incorporating co-investment, for example, as a way of lowering costs."

Since inception, Pantheon has formed in the region of 50 primary funds-of-funds, also called blind pools of money.

The manager has an ongoing relationship with 475 LPs and has made 644 fund investments to date. Commingled investment strategies typically make commitments to approximately 35 primary PE funds across a three-to-five-year period. Generally speaking, commingled strategies are seeing more concentration these days with less than 35 funds becoming more common.

Pantheon is also very much mid-market focused with a target buyout fund size north of $500m.

"We have always focused on mid-market funds. Institutional clients can usually get access to the mega-funds themselves. We don't major on venture where there can be a huge dispersion of returns, but we are long-standing venture investors and it's a space we know well globally," says Ward. He adds that the same is true of brand new first-time funds, which Pantheon generally steers away from unless the individuals are themselves well known to it and their previous track records have been consistently strong.

Pantheon typically invests in around 50 primary GP funds each year (though it tracks around 9,000) with ticket sizes generally representing between 2-6% of each fund. The number of GP investments would naturally increase when commitments to secondaries are included.

The firm is often a reference investor and has a seat on the advisory board of 345 global funds.

Co-investment spotlight

"We are active co-investors on behalf of our clients," says Ward. "You can learn a lot about an investment manager in a co-invest and it can reinforce or further inform your investment conviction of their fund."

Pantheon launched its co-investment platform in 2005 and in 2009 formed its first dedicated fund to the strategy. The team has committed $2.5bn to date as of Q3 2017 across 155 deals. It typically takes a relatively small position in private equity co-investments. Sometimes, in infrastructure, there may be some co-underwriting involved.

"Our co-investment approach is focused on being involved from the start rather than participating in post-deal syndication," says Ward. "Most GPs are managing co-investment syndication in a thoughtful way to enhance their LP relationships and not disappoint their LPs. GPs have also become increasingly comfortable and confident that they can syndicate co-investments successfully with their LP base. However, there are varying approaches that can be driven by the nature and capability of the LP base and the dynamics of the transaction. Occasionally, the nature or speed of the transaction necessitates the GP to go to the LPs in which they have the most confidence, because ultimately they need to get their deal done and not disrupt their own deal process."

A recent co-invest was with CVC for the acquisition of US-Israeli cybersecurity management firm Skybox Security. CVC Capital Partners' growth fund made a $150m investment in the firm with Pantheon adding a further $50m to the deal. This was an example where Pantheon was part of the negotiations with the GP at a very early stage in the process.

Although many LPs and funds-of-funds are moving from a heady time of co-investment to direct investment, this is not something Pantheon is focused on, according to Ward. "This isn't an area we look at. We believe there are conflicts and as a fund investor, it wouldn't be worth us doing one deal that could compete with our GPs or sour our important relationships. Co-invest and co-underwriting is not going away, though the line may start to blur a bit more between co-invest and direct [strategies]."

Key People

• Paul Ward, managing partner and member of the partnership board, joined Pantheon from Lehman Brothers Private Equity Group, where he was investment director. Prior to that, he worked for Lehman Brothers Investment Bank in both New York and London on M&A and corporate finance advisory services having previously been a management consultant with PA Consulting.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds