GP Profile: Baird Capital

Baird Capital held a $310m final close for its first globally focused private equity fund last year, with the vehicle being deployed by teams in the UK, US and China. Oscar Geen talks to partners from each team to discuss the firm's new approach and future plans

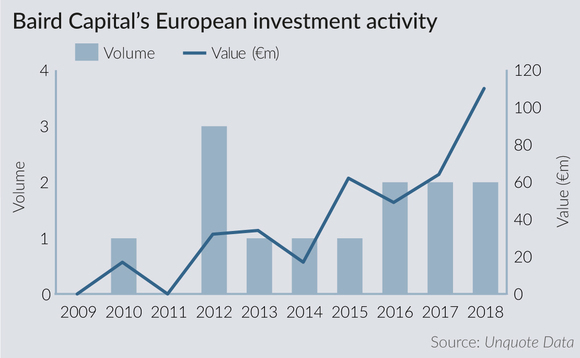

All three of Baird Capital's teams – US, UK and China – now invest from the same capital pool, but this has not always been the case. Baird's US team held a final close for its fifth fund on $290m in 2010, while the UK team raised two previous funds under Baird Capital's banner, Baird Capital Partners Europe Fund I (which held a final close on €204m in January 2006) and Baird Capital Partners Europe Fund II (which hit €146m in June 2013). The UK team had also raised a series of funds prior to this under the name Granville, prior to its acquisition by Baird in 1999.

Andrew Ferguson, a partner in the firm's UK private equity team, was already at Granville at the time of the acquisition. Ferguson joined Granville when North Of England Ventures, where he was an investment manager, was acquired by it in 1996. He explains the rationale for consolidating the regional operations: "Prior to 2016, we had these separate funds with similar investors doing roughly the same types of deals in different regions, and when we all sat down as a partner group we came to the conclusion that there was a better way of structuring it. The idea was to take the best practice that we had developed individually and consolidate PE operations globally, which led to the launch of the global platform."

Baird Capital Global Fund held a final close on $310m in June 2017 and is approximately 50% deployed across six deals at the time of writing. Alongside the US and UK teams, it incorporates the Chinese operations. Partner in the China team, Andy Tse (pictured above), explains that the focus is slightly different, as the country's PE industry is still in its infancy. "In Asia, we are currently doing minority investments. Most business owners don't want to give control to private equity so either you pay a very high price or you do a minority investment," he says. "We may do buyouts in the future when the market becomes more mature."

"Our early foray into China was looking at our UK and US portfolio companies with operations there," Ferguson explains. One of Baird's UK-based portfolio companies, Paddock, was sourcing a specific part purely from China. "We sent our team to have a look at the facility and it turned out the production had been outsourced elsewhere to a sub-optimal facility. That was an area we could immediately add value through our network." Baird eventually generated a 2.7x return on the sale of Paddock to trade buyer Assa Abloy.

International networks

It was this kind of cross-border collaboration that formed the basis for the global platform. Ferguson says: "We look for companies that can benefit from having a global partner that brings an international outlook. We think this is often the best way to create value for companies in the sub-€100m enterprise value space."

Brett Tucker is also a partner at the firm and is currently based in the US office, although he has previously spent time in China, with Baird and other PE firms. Tucker says the global approach allows the firm to capture global trends such as Chinese students studying overseas. "Once we decided that we wanted to do a deal in the education services sector we started looking at a number of businesses," he says. "We started due diligence on a UK business and obviously the US and the UK are the top destinations. Most of the students are coming from Asia so all three offices were working on it. We like to say that the sun never set on that deal."

Baird ultimately lost out on the auction in question but remains committed to the sector. Tse outlines some of the figures behind the investment thesis: "The market for Chinese students going to study overseas in university or other forms of education is 800,000 students per year and these students spend between $40,000-50,000 per year. This is what is driving our interest in the education services sector in the region."

Well resourced

Baird's investment remit focuses on healthcare, industrials, technology and specialised services. The firm's investment banking operations operate in all of these sectors and are able to provide sector expertise and knowledge on a case-by-case basis.

Tucker says: "We definitely use our international network in our pitch to business owners. For a Chinese medical equipment service provider we were bidding for we arranged a US tour of potential customers for the CEO and introduced him to all of our contacts in his industry. We made sure he knew what he was getting if we won."

As well as sector expertise, Baird has developed some horizontal operational resources. "You can't hire a specific person to deal with every problem your portfolio companies face, but there are some we encounter regularly," says Ferguson. "Recruitment and retention of talent was a big [recurring challenge], so we recently brought in Melissa Mounce in the newly created position of human capital leader."

Baird also has a German team, led by Mathias Schirmer and Martin Beck. For administrative reasons it does not currently make investments from the Global Fund but this is likely to change in the future. "Our team in Germany are very much part of the global platform," says Ferguson. "We continue to see this market as offering significant opportunity for a mid-market investor such as ourselves."

Baird declined to comment on any future fundraising plans but there is clearly the capability for further expansion. Asked to consider locations for a hypothetical new office, Tse suggested south-east Asia, whereas Ferguson had other ideas: "I feel like we're pretty well covered at the moment. Maybe India. There are certainly no immediate plans."

Key People

• Andrew Ferguson, partner in the UK private equity team, joined Granville when it acquired North of England Ventures in 1996. He then joined Baird when it in turn acquired Granville in 1999. Prior to that he worked in corporate finance for PwC.

• Brett Tucker, partner in the US private equity team, joined Baird in 2003 and worked on LBOs in the US for four years before moving to help develop the China Growth Equity team in 2007. He previously spent three years in Shanghai with investment advisory firm Pacific Rim Resources.

• Andy Tse, partner in the China growth equity team, joined Baird in 2016 from AIF Capital where he led industrial and service sector investments across most of Asia. Tse previously worked for Hopewell Holdings and its subsidiary Consolidated Electric Power Asia with a focus on investment management.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds