Then and now: European private equity's post-Lehman decade

With European private equity coming to a virtual standstill 10 years ago, Unquote compares key statistics to assess how the market mostly recovered to its pre-crisis vigour

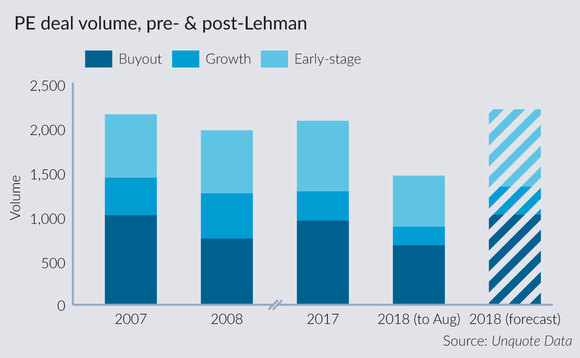

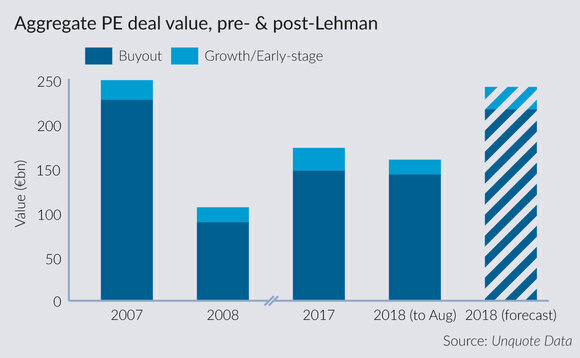

It has taken exactly a decade for European private equity to get back to the investment activity levels last seen in the pre-crash record of 2007 – with a few caveats. That year, according to Unquote Data, Europe was home to 2,145 PE investments, including more than 1,000 buyouts. These deals amounted to a then-eye-watering €248bn in estimated aggregate value.

This feat, of course, would not be repeated the following year. Despite a strong start to 2008 in volume terms, activity ground to a halt in the second part of the year and, ultimately, the overall amount of capital deployed on the continent nose-dived by more than 50%. The first full post-crash year, 2009, was predictably even more abysmal, as leverage options dried out and GPs settled into a holding pattern, while still hauling record amounts of dry powder secured mere months prior.

However, Unquote Data statistics show that the recovery has been, for the most part, immediate and relatively steady. Activity levels rebounded significantly (albeit from a depressingly low base) in 2010 and, bar a small plateau around 2011-2013, went on to almost match 2007's volume numbers last year.

That said, while growth and early-stage aggregate value in 2017 actually exceeded that seen in 2007, buyout value was still down by a third compared to that record year, mostly due to a lower volume of mega-buyouts. The first eight months of 2018 have been buoyant, though, and extrapolating on the activity levels seen so far (assuming that the fourth quarter will stay on that trajectory) should see both the volume and value of investments come within touching distance of the 2007 records.

Replenishing the coffers

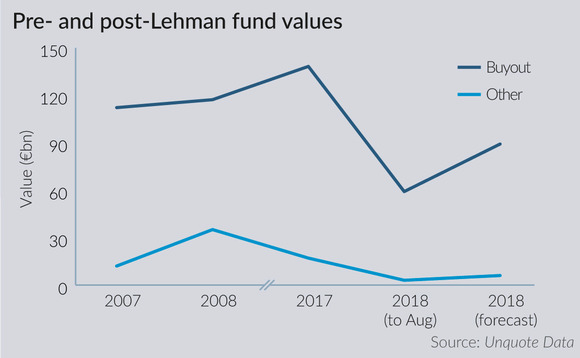

This hike in activity goes hand in hand with a spectacular recovery in fundraising numbers. This predictably took slightly longer to kick in given the aforementioned levels of dry powder accumulated between 2005-2008, but the real uptick came around the 2015 vintage. While the number of fund closes did not jump up significantly, the return of large-cap players on the trail and LPs' appetite for allocating larger tickets to PE meant that multi-billion fundraises and swelling mid-cap efforts made a definite impact on statistics.

This culminated in the aggregate amount raised for buyouts funds last year breaking the pre-crisis record, and convincingly: vehicles with a remit to invest in Europe raised a collective €140bn, compared with €114bn in 2007. This is unlikely to be replicated in 2018 based on preliminary figures, with the Unquote Data estimate placing the year-end total closer to the €90bn mark – suggesting that the peak of the cycle may have been reached last year.

It is, however, conceivable that a small number of fund closes by large-cap players could edge 2018's figure close to 2007's, albeit still well short of 2017's. Permira is currently targeting €2bn for Permira Growth Opportunities I, which held a first close in March 2018 and will make minority investments in high-growth technology-enabled businesses. Meanwhile, Exponent Private Equity is targeting £1.5bn for its fourth buyout fund, which it registered in July 2017.

This is where the transformation of the market in the post-crisis decade becomes significant, though. The increasing appetite for alternatives in a persistently low-yield environment, combined with increased sophistication and ambition on the part of large institutional investors, means LPs have developed other ways to reach their allocation targets.

The rapid development of co-investments, direct investment arms and discretionary mandates makes accurately measuring the overall amount of capital flowing to PE a much harder exercise – but recent research by placement agent Triago suggests around 30% of all capital committed to PE in the first six months of 2018 worldwide ($96bn) went to shadow capital, up from 12% ($67bn) a decade ago.

Old tricks

This disconnect between record fundraising numbers outpacing deployment rates (despite healthy activity levels over the past couple of years) has inevitably invited unflattering comparisons to the 2005-2007 period.

With increased competition for a relatively low number of high-quality assets, pricing levels have climbed back to the heady pre-crash days, leaving LPs in particular worried about future performance – if 12x is the new normal and 15x the going rate in hot sectors, what will returns look like should the market take a turn for the worse in the coming two to five years?

Another area of concern recalling the excesses seen a decade ago is leverage, especially looking at headline ratios for the most high-profile deals – unthinkable five years ago, total leverage multiples in the 7x region started making a comeback in 2017. But according to David Parker from debt advisory firm Marlborough Partners, the complete picture is more nuanced: first-lien leverage may have climbed back to 4.9x (versus 4.6x in 2007), but average total leverage is down by nearly a turn of EBITDA (5.4x against 6.1x a decade ago). Furthermore, he adds, equity cushions are much more lender-friendly: the average in 2007 stood at 33%, while it is now closer to 45%.

This is not to say that concerns over leverage-related risk are completely unfounded, with two areas in particular highlighting how the market has transformed in the past decade. The inexorable rise of credit funds and banks' willingness to fight on even terms without over-leveraging has notably seen cov-loose and cov-lite deals becoming a fixture in recent years; according to Parker, the latter account for more than 80% of packages now, compared with less than 10% in 2007.

The potential impact on portfolio companies should the macro environment turn sour remains a concern. And the rise of fund-level financing, which is by definition more opaque, has led some LPs to question both the reporting of fund performance figures and the introduction of further risk at the portfolio level in the case of a potential macroeconomic shock.

Comparing these various metrics paints a contrasted picture of the European PE industry 10 years on from the Lehman collapse. But raw numbers also fail to convey how the industry has transformed in that decade – the increasing importance of ESG has had a significant impact on how fund managers run their portfolios and report to their LPs, technology has led them to rethink both their own processes and those of their investee companies, and returns are now less dependent on multiple arbitrage and/or leverage plays, to name just a handful of long-term trends. Most of these developments are also still ongoing, which should ensure that the industry will not be short of fresh challenges and opportunities in the coming decade.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds