European fundraising cools down after bumper 2017

The number of fund closes by European private equity firms and their aggregate commitments have slowed down during 2018, after the breathless pace set over the previous couple of years. Greg Gille reports

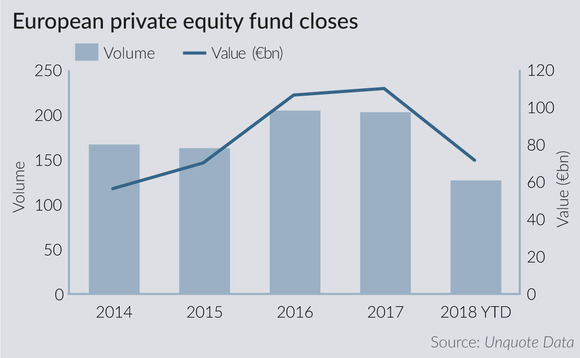

Both 2016 and 2017 were exceptional vintages for European private equity from a fundraising standpoint. According to Unquote Data, Europe-based GPs closed 200 funds in 2016, hauling in a record €138bn. That pace was sustained in 2017 as well, with a further 202 vehicles holding a final close, this time bringing in €131bn. This comfortably exceeded any past yearly records, including the previous heyday of 2006-2007.

Looking at similar metrics in 2018, the market has undeniably cooled down: Unquote has recorded 118 fund closes for total commitments of €77.5bn, including the latest effort by Hg (the Saturn fund, closed on £1.5bn in late October).

Part of this is the inevitable ebb and flow of fundraising cycles, with a number of industry heavyweights closing large funds over the 2016-2017 period. Refining the Unquote Data sample shows that 27 vehicles closed in excess of €1bn in 2017 (including the behemoth €15.5bn CVC Capital Partners VII fund), for aggregate commitments of €84bn. So far in 2018, only 16 funds in that bracket have made it across the finish line, led by the likes of EQT VIII (€10.75bn), BC X (€7bn) and PAI VII (€5bn), leading to a €31bn drop in total commitments.

"I would qualify 2018 as a robust year for fundraising so far, although not as strong as last year - partly because a number of very large funds came back to market in 2016-2017," says Capital Dynamics managing director Angela Willetts. "Some of the UK funds in particular came back to market earlier than planned due to their investment pace. We have been seeing slower dealflow in the UK more recently and that is bound to have a knock-on effect on the timing of upcoming fund launches."

"Some investors may have also over-allocated in 2016-2017 given the number and quality of the funds that came to market then," she adds. "If they have fixed allocation targets, these investors will inevitably have to reign back in subsequent vintages and that might be at play here."

Nicolas Vagner, who co-runs Lazard's PE fundraising efforts in Europe, adds that the market remains difficult for managers that have neither the clout of larger, established brands, nor the appeal of mid-market country champions or sector specialists: "The window of opportunity is clearly still there, but once you take the large fundraises out of the statistics the picture is more nuanced. The market remains liquid for managers who can truly differentiate themselves and generate consistent risk-adjusted returns. But it also remains incredibly crowded, with fierce competition for LPs' airtime and limited new slots into their increasingly mature portfolios. This is further compounded by managers accelerating their fundraising timelines ahead of a potential turn in the cycle next year."

Coming up

The more muted headline figures for 2018 so far could indeed be influenced by the fact that a number of big names are either currently on the road, or expected to go back to market in the coming months, leading investors to keep some of their own powder dry in anticipation.

Unquote has recorded 130 funds launched since January 2017 that are still on the road. A number of these have already held first and/or interim closes, raising close to €12.8bn. Looking at the targets of these vehicles, that is a potential €66bn in the pipeline that could add to the fundraising tally in the next six to 12 months.

This includes a number of large secondaries funds, such as Coller International Partners VIII (which aims to raise as much as $9bn) and Ardian Generation Mature Secondary ($8bn target). Large funds currently on the road on the buyout side include the likes of Altor with its €2.5bn effort. Triton is also understood to have hit the trail recently with its latest vehicle, which could haul in as much as €3bn. Meanwhile, Exponent is still on the road for its fourth fund, originally launched with a £1.3-1.5bn target – although more recent media reports indicate this could be revised down to around £1bn.

We have been seeing slower dealflow in the UK more recently and that is bound to have a knock-on effect on the timing of upcoming fund launches" – Angela Willetts, Capital Dynamics

Looking a bit further down the pipeline, Unquote is tracking a number of funds due to come to market in the coming months. As of June, Permira was understood to be in early talks with investors regarding the launch of its flagship seventh fund, Permira VII, with a target of €10bn, and was expected to start the fundraise in early 2019. Partners Group's direct investment vehicle, Direct Equity 2019, is expected to launch in Q1 2019 with a target of €5bn. Meanwhile Carlyle recently registered its newest fund, Carlyle Europe Technology Partners IV, the predecessor of which had raised €656m. Other GPs that could hit the trail soon include the likes of Investindustrial and Astorg Partners.

Willetts says that, as an LP, Capital Dynamics is currently "not short on things to look at", with a good pipeline of re-ups in addition to interesting emerging manager opportunities. But she also highlights that selectivity is high in order to avoid pitfalls in the current environment: "Currently we include a focus on managers specialised in more complex transactions, as this helps alleviate some of the concerns around high pricing for assets. The looming Brexit deadline is a also a factor when looking at UK funds – these usually generate robust discussions at the investment committee level."

With a number of high-profile managers having replenished their coffers over the past 24 months – especially at the larger end of the spectrum – and with growing expectations that the market could soon be entering a correction phase, it is likely that headline European fundraising figures will settle at lower levels compared with 2016-2017. But as a number of successful closes in recent weeks can attest, the right opportunities are still well placed to catch the eye of LPs.

Top 5 European fundraises of 2018

|

GP |

Fund name |

Amount raised |

Fund target |

|

EQT Partners |

EQT VIII |

€10.75bn |

€8bn |

|

BC Partners |

BC European Capital X |

€7bn |

€7bn |

|

PAI Partners |

PAI Europe VII |

€5bn |

€4bn |

|

Nordic Capital |

Nordic Capital IX |

€4.3bn |

€3.5bn |

|

Towerbrook Capital Partners |

TowerBrook Investors V |

$4.25bn |

$4bn |

Source: Unquote Data

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds