French PE market overtakes UK

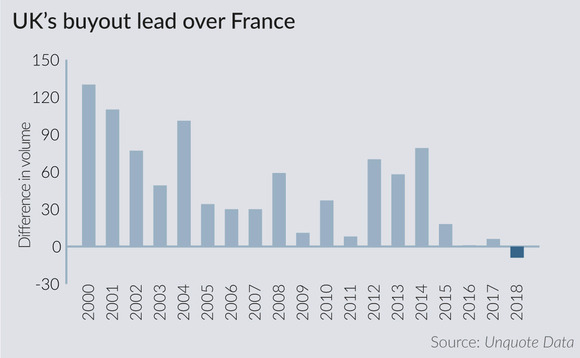

The French buyout market has overtaken the UK's on an annual basis for the first time on record, according to new figures from Unquote.

There have been 213 private equity buyouts of French companies so far, with little of the year left go. This compares favourably with the UK's 204 buyouts. France also beats its all-time record of 211 set last year while the UK's buyout volume looks certain to finish the year short of last year's 217.

Both regions are experiencing volatile and exciting industry-specific dynamics, and local GPs have plenty of capital to deploy, but politics continues to cloud the macro picture.

"2018 began on solid territory in France with the Macron effect still in full swing and on the back of a promising reform agenda. This was in stark contrast with the uncertainty Britain faced with Brexit. As the year has unfolded, the gilets jaunes are dampening the Macron agenda and France's old demons of fiscal ambiguity are resurgent," says Christopher Masek, CEO of IK Investment Partners.

"The fundamentals of the depth of the French PE market remain nevertheless robust with teams continuing to invest and expand, and very successful fund raises of several national champions including PAI, Ardian and Astorg. This trend is lacking in a UK market still affected by the uncertainty surrounding the outcome to Brexit with less investment in UK-focused funds."

Karsten Langer, partner at Riverside Europe, says: "To some extent, you are being asked to price political risk in an extreme way and that's not what we're experts at. We can find good companies and grow them, but this is a cliff edge situation where it happens or doesn't.

"If you're right, you'll be called lucky, but if you're wrong you'll be called stupid, so it's hard to do."

Big hitters

France also outdid the UK in terms of aggregate buyout value. The value of French buyouts reached €32bn, the most since 2006, while the UK posted €27bn's worth of deals. It is the third time on Unquote records that French deal value has exceeded the UK's, having done so in 2016 and 2006.

Despite robustness in the lower-mid-market, there has been a notable slowdown in large-value deals in the UK this year, which has weighed heavily on aggregate deal value – 2018's value is down 32% on last year's €40bn. The starkest sector outperformances in France were in consumer goods and industrials, where significantly more deals were completed than in the UK. Meanwhile, the UK posted more deals in tech & telecoms and consumer services.

Fundraising in the UK has also dipped, which market players put partly down to uncertainty and partly due to particularly successful fundraising in recent years.

Richard Howell, partner and head of the investor relations and capital markets teams at PAI Partners, explains that LPs were quite slow at reacting to Brexit developments in 2016 and 2017: "It's only in the past 12 months that investors' confidence has been relatively affected as they have started to witness more tangible effects such as political instability, currency volatility and a sharp slowdown in consumer-facing activity (notably retail).

"LPs have been asking questions about UK deployment strategy for a while now. More recently, this has intensified to questions regarding what preparations portfolio companies have in place for a hard-Brexit or no-deal. Our impression is that LP concerns are greatest among those investors located outside of Europe. Naturally the further away you are, the greater the tendency to put things on hold until there is more clarity."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds