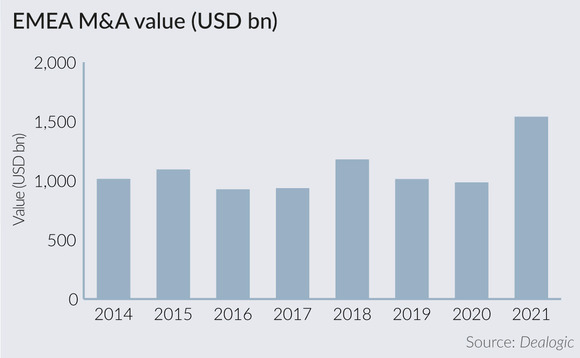

EMEA M&A surges in 2021

The clouds parted for EMEA-based deal-makers in 2021, as M&A activity in the region charged to its highest annual value since 2007, writes Jonathan Klonowski.

Driven by easy financing, a push for corporate reorganisation and acquisitive private equity funds, deals of all sizes made for a stellar year.

More than 10,500 deals were recorded in 2021, worth a combined USD 1.54trn, representing a 56% hike in volume from 2020 and the third-highest annual value on Dealogic record. This mirrored global M&A activity, which set a record for value at almost USD 6trn.

EMEA M&A activity was consistently robust throughout 2021; the region has now seen at least USD 300bn in deals for five successive quarters. The fourth quarter was particularly bright for business, with the highest value since Q4 2007. This marked a continuing rebound from H1 2020, when the Covid-19 outbreak rained on deal-making activity.

Wet market to dry powder

A spike in mega-deals has been key to the recovery. After only 83 deals of at least USD 2bn in 2020, worth a total of USD 578bn, there were 156 such deals of at least USD 2bn, generating a total of USD 896bn. Seven deals worth at least USD 20bn were recorded last year, including the USD 31bn tie-up of Vonovia and Deutsche Wohnen.

The year's biggest star was KKR's preliminary approach to Telecom Italia for USD 40bn in cash and debt, which would make it the largest-ever leveraged buyout in Europe, eclipsing the USD 17bn takeover of ThyssenKrupp Elevator, announced on the eve of the pandemic.

KKR's bid pushed PE-driven deal-making to new heights last year. Sponsors awash with financing deployed a staggering USD 318bn in 2021, almost double the previous year's total, and the highest annual value on record. PE firms' ambitions were aided by corporate divestitures. In November, for example, CVC snapped up Unilever's black-tea business for USD 5.1bn.

The trend looks set to continue in 2022, with Antin reportedly starting a disposal of Spanish fibreoptic firm Lyntia and several PE funds circling. Meanwhile, EQT-backed Sitecore, a Danish digital-marketing software provider, is reportedly garnering interest from sponsors.

Internet of ka-chings

As the clear winner from pandemic-related lockdowns, tech continues to dominate M&A activity. The sector was once again the most active in EMEA by a wide margin, as it was globally, with strategic and sponsors alike pursuing tech assets.

M&A in the tech sector soared to a record USD 312bn across EMEA, smashing the previous record of USD 181bn set in 2020. This included SPAC deals for firms such as eToro, Cazoo and Pagaya.

The sector has now hit the USD 100bn mark in five of the past six years, and shows no signs of slowing down. Several high-profile deals are in the offing. Vista Equity-backed Finastra, a UK-based financial software firm, has reportedly retained Credit Suisse for a sale that could realise up to USD 4.5bn.

Because of this boom, investment banks' M&A advisory fees scorched to USD 11bn last year in EMEA, an all-time record. The 2021 figure rose 63% from 2020, in which USD 6.6bn in fees were recorded. JP Morgan led the way in EMEA, with 249 deals and USD 1.1bn earned last year. Goldman Sachs closely followed, earning USD 990m for 215 deals.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds