Buy now, realise later - sponsors go on spending spree amid exit lull

Private equity funds have been spending lavishly in the year-to-date (YTD) making a record 697 buyouts in EMEA; exits, though, have dipped as those same funds fear cashing out on weaker market valuations.

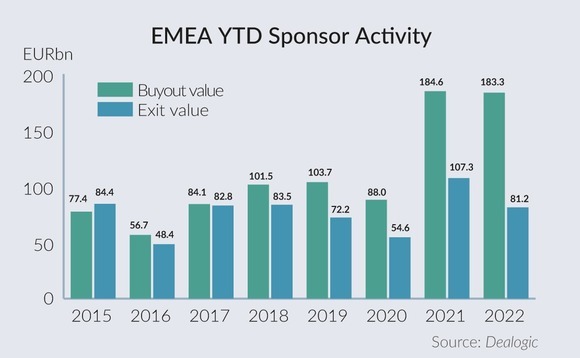

Exits from sponsor-backed firms are down nearly a quarter by value to EUR 81.2bn in the YTD compared to 2021, while buyouts remain just 0.7% behind last year's record-breaking activity at EUR 183.3bn, according to Dealogic data. Compare this to total M&A value, which is down 5% versus YTD21.

Sponsors also continue to up their muscle in overall M&A, with platform deals now accounting for 25.7% of the total value in the YTD, up 110bps.

Valuation hang-ups are clear from the number of 1H22 processes that have collapsed or are yet to complete. Capiton recently shelved a dual-track of its German CDMO KD Pharma on those grounds, while Bridgepoint's exclusivity for G Square's French dental chain Dentego collapsed over price expectations.

Burn a hole in PE's pocket

The splurge is driven by ever-growing heaps of dry powder - take Advent International's record USD 25bn (EUR 24bn) fund - and a correction in valuations. However, if sponsors are selling fewer assets, then buyers must look elsewhere to shell out.

Primary buyouts are up as founders look to realise value or raise capital for expansion before a further downturn. The biggest deals YTD include CD&R's GBP 2.5bn (EUR 2.8bn) merger of UK facilities managers Atalian Servest and OCS, and Goldman Sachs Asset Management's EUR 1.9bn acquisition of Dutch pharmaceuticals company Norgine.

EMEA corporate carve-outs are on track to reach total values of 2021 and 2020, at a total deal value of EUR 56.5bn. Noteworthy transactions included Astorg's EUR 2.5bn acquisition of CordenPharma from International Chemical Investors Group, and Bain Capital and NB Renaissance's buyout of French IT services firm Inetum from Qatar-based Mannai Corporation.

Public-to-privates also remain a creative way to splurge, like Astorg and Espiris's joint GBP 1.6bn (EUR 1.9bn) de-listing of market news organisation Euromoney. So far, 26 such deals have been announced this year in EMEA, worth a combined EUR 72.8bn. This represents the highest YTD value on Dealogic record.

Top 5 public-to-private buyouts in EMEA in 2022

| Announcement Date | Target | Acquirer | Deal Value (EURbn) |

| 14-Apr | Atlantia SpA (66.9%) |

Blackstone Inc Edizione SpA |

42.7 |

| 19-May | HomeServe plc | Brookfield Infrastructure Partners LP | 5.5 |

| 17-May | ContourGlobal plc |

KKR & Co Inc Cretaceous Bidco Ltd |

5.5 |

| 28-Apr | Albioma SA | KKR & Co Inc | 2.6 |

| 07-Jun | Biffa plc | Energy Capital Partners LLC | 2.3 |

Source: Dealogic

Sample sale

Sponsors still face the obvious pressure to liquidate assets at the tail-end of a fund cycle, leaving owners to assess two main options going forward: to accept the price on the table or to push the asset into a secondary.

There are signals that some sponsors have sold slightly lower than expected. Hg was targeting a EUR 1bn price tag on German care software developer Medifox Dan but settled just below at EUR 950m in a trade sale to ResMed.

As for continuations, KD Pharma has already gone that route reducing pressure on the collapsed sale. Triton's Assemblin and Novum Capital's MMC Studios have also faced similar fates to avoid spreads in price expectations or help wind down funds.

But with funds always marching towards expiry, exits will have to increase. Buyers look set for some bargains in the New Year sales.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds