Platform boot camp: Buy-and-build holds fast in healthcare sector

Times might be hard for dealmakers in Europe, the Middle East and Africa (EMEA), but healthcare remains one of the most resilient sectors. And private equity (PE) firms are betting on platform-building as a winning strategy for healthcare while valuations remain low across the board.

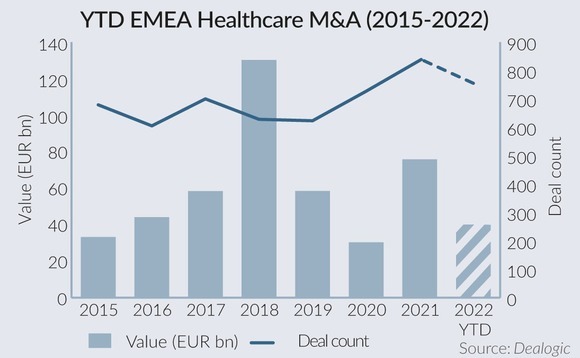

As noted in August, PEs have been spending lavishly, while mostly largely keeping exits on hold. So far this year, healthcare deals have helped keep headline M&A figures for the sector within spitting distance of last year's result - something that isn't true of EMEA M&A values as a whole.

To date, EUR 843bn has been deployed in healthcare acquisitions in EMEA this year, a drop of 10.9% compared to YTD21's value, according to Dealogic data. Deals in healthcare represent around 7% of the 10,722 M&A deals announced YTD in the continent, and around 4.7% in value, also according to Dealogic data.

A recent example of a deal is Naxicap-backed, Belgium-based pharmaceutical company Ceres Pharma which acquired nutritional supplements developer and distributor Labophar earlier this month. The rationale behind the deal was to give Ceres Pharma an e-commerce platform, as reported by Unquote sister publication Mergermarket.

PE's best friend

In tackling healthcare, PEs aren't just thinking about humans, but also our best friends, too. Our four-legged companions were among the stars of the M&A market in Europe, notably in France, the second EU member with the highest healthcare expenditure relative to GDP in 2019 according to Eurostat (11.1% vs 11.7% for winner Germany).

In June, Infravia Capital Partners acquired French pet care specialist Univet from Platina and went on a spree of buy-and-build deals, starting with peer Vet Canine, which it bought the same month. This October, Univet also completed the acquisition of French veterinary expert Hopia.

In Germany, EQT-owned IVC Evidensia picked up a big bone by acquiring the local veterinary facility Kleintierzentrum Greven this September. IVC Evidensia has been on a European shopping spree with owner EQT since the private equity firm bought IVC in 2016. This year IVC Evidensia has proven Germanophile with three pet care deals in the country, Kleintierzentrum Greven but also peer Tierklinik Hofheim and Tierklinik Kalbach.

Top 5 EMEA Healthcare Financial Sponsor Buyouts (2022)

| Announcement Date | Target | Acquirer | Seller | Deal value (EURm) |

| 20-Jan | Kedrion SpA (100%) Bio Products Laboratory Holdings Ltd |

Permira Ltd; Abu Dhabi Investment Authority Ltd-ADIA; Permira Funds IV |

FSI SGR SpA Tiancheng International Investment Ltd |

2,410.1 |

| 19-Apr | Affidea BV (100%) | Groupe Bruxelles Lambert SA | B-FLEXION Group Holdings SA | 1,764.1 |

| 17-Jan | Biofarma SpA (100%) | Ardian SA; Gabriella Tavasani (Private Individual); Germano Scarpa (Private Individual) |

White Bridge Investments SpA | 1,100.0 |

| 20-Apr | Sanoptis AG (100%) | Groupe Bruxelles Lambert SA; Existing Management |

Telemos Capital Ltd | 750.0 |

| 06-Oct | Equashield LLC (25%) | Nordic Capital Svenska AB | Eric Shem-Tov (Private Individual) | 304.3 |

Source: Dealogic

Need a hand?

One area that is likely to see PEs deploying buy-and-build strategies is French radiology, according to proprietary intelligence from Mergermarket. The industry, which is worth up to EUR 6bn, is very fragmented, with 4,000 radiologists working privately and another 1,000 mixing public and private work.

However, Spanish hospital services could buck the trend due to incoming regulations, which could add an extra layer of bureaucracy into public-private collaborations, according to proprietary intelligence from Mergermarket. One of the companies that could be hit hardest by the proposal is Quirónsalud, which has received inbound interest from PEs, according to the Spanish press.

Meanwhile, some of the mature platforms are edging towards an exit as their sponsors' buy-and-build strategies draw to a close, despite low valuations overall.

For example, VetPartners, the BC Partners-backed veterinary care chain, has a score of 68.33 on Dealogic's Likely To Issue (LTI) sponsor list. This September, BC Partners was reported to be preparing its exit for the business, which has gone from a GBP 47m (EUR 54m) in EBITDA in 2018 to GBP 150m-GBP 200m today.

In the current environment, dealmakers who find their work in other areas drying up might want to think about asking their healthcare colleagues if they need a hand with any deals.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds