Many-headed Hydra: Private markets manager consolidation rears its head

The mythical beast of Greek legend, Hydra, was a gigantic serpentine water monster with nine or more heads, one of which was immortal. In some versions of the legend, whenever one was cut off, it would grow two more.

General partners (GPs) might not be serpentine monsters, but one contemporary trend evokes the ancient myth. GPs that have historically focused on one investment strategy, whether it be private equity (PE) or fixed income, are at the forefront of a new wave of strategic M&A among multi-strategy asset managers.

BlackRock's recent acquisition of Kreos Capital, a London-based credit shop for high-growth companies, is a case in point, with the buyer saying it "provides clients with a diverse range of private markets products and solutions."

Meanwhile, Brookfield Asset Management bought the PE secondaries unit of DWS Group, the asset management arm of Deutsche Bank, earlier this year. Private credit groups Arcmont and Alcentra were bought by Nuveen and Franklin Templeton respectively.

Selection of related European deals announced since Jan 22

| Filing/Announcement Date | Target | Acquiror |

| 08-Jun-23 | Kreos Capital Management (UK) Ltd | BlackRock Inc |

| 27-Oct-22 | Arcmont Asset Management Ltd (Con%) | Nuveen Investments Inc |

| 23-Aug-22 | Access Capital Partners (24.5%) | Alantra Partners SA |

| 16-May-22 | Sofinnova Partners SAS (Min%) | Apollo Global Management Inc |

| 09-Mar-22 | 17Capital LLP (Maj%) | Oaktree Capital Management LP |

Golden sword

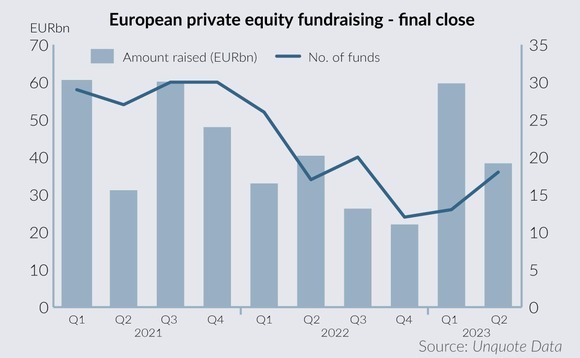

Despite the trend for multiple heads, fundraising continues to be a weak spot in the sponsor landscape. Thanks to the denominator effect, limited partners (LPs) are squeezed for commitments, flocking to the combination mix of specialist strategies and well-established GPs.

A total of 31 funds targeting Europe have closed so far this year, according to Unquote Data, a 27.9% fall versus the equivalent period last year.

"Clients are choosing fewer managers, there are bigger bites of the pie going to fewer groups, which is creating scale among a smaller handle of institutions," said one large multi-asset manager.

However, the new arm for Blackrock does help to fill some of the market void for startups seeking non-dilutive capital solutions that was left after the collapse of Silicon Valley Bank.

Regeneration

The trend is unlikely to affect consolidation among the private equity space itself, despite many in the mid-and large-cap space struggling to raise capital. "It's tough to consolidate thousands of private equity firms," said the co-president of one large GP.

"Through every boom and bust, those who don't have enduring performance will go away or shrink down to normal size."

Value-creation is going to be "vital" for those who want to escape the bust, but to achieve that "you need access to capital and operational complexity, which you can only do if you're driving multi-asset solutions," said the global head of private equity at a further asset manager.

Brookfield is predicting further consolidation, saying that like "virtually all sectors" there are up to ten major players in the world, in a letter published alongside its Q1 results. It, alongside groups like Apollo Global Management, Franklin Templeton, Oaktree and other large managers are expected to be at the forefront of that wave.

In the Heracles legend, not only was Hydra hard to kill. but its poisonous blood could be harvested for further challenges. GPs who are too small to develop a true multi-strategy approach might still want to dip their arrows into Hydra's neck as they move away from just one approach.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds