Oaktree Capital

Many-headed Hydra: Private markets manager consolidation rears its head

Multi-asset managers set to roll-up credit, infrastructure and secondaries players to add strategies for scale

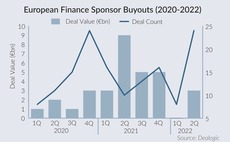

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

Oaktree exits Ascot Lloyd to Nordic Capital

New owner is acquiring the UK-based independent financial advisor via Nordic X

Oaktree and 17Capital announce strategic partnership

Oaktree is to take a majority stake in the London-headquartered specialised NAV financing provider

Ligue 1 to collect second round bids for media arm in April

CVC, H&F, Silver Lake, Oaktree among shortlisted bidders for Ligue de Football Professionnel's asset

Oaktree to acquire RAFI

Investment is expected to support the company's growth and international expansion

Oaktree's Agro Merchants buys Cool Pak

Netherlands-based Agro Merchants buys Cool Pak for its facilities on the US west coast

Oaktree Capital exits Railpool

Oaktree wholly acquired the company in 2014 and partially exited the company in 2016 to GIC

Nordic Capital in talks to acquire Oaktree's Hesira

Value of the European dental business could near тЌ480m, according to reports

Oaktree acquires Vitanas and Pflegen & Wohnen

Care home business has recently invested in modernising and expanding its facilities

Cornerstone, Oaktree buy Poland's ProService from Highlander

Deal sees the US-based investor team up with local GP Cornerstone Partners for the Polish SBO

Deal in focus: IK buys Evac

IK's purchase of Evac comes after years of courting the company

Cerberus and Orion pick up Sotogrande

Private equity houses had been bidding for the company since April

Oaktree acquires Railpool

Company to provide Siemens with five locomotives in coming months

Private equity eager to cash in on real estate bubble

The much-debated property bubble has economists worrying over soaring inflation rates. However, for the buyout community, a rush of first-time buyers and a flood of foreign money has those supporting the property industry licking their lips in anticipation....

Oaktree-backed Panrico to undergo restructuring

Panrico, the Spanish pastry and bread firm backed by Oaktree Capital, has appointed economist and lawyer Carlos Gila as first executive to oversee its restructuring.

Advent mulls DFS listing

Advent International is in the early stages of considering a listing of home furniture retail chain DFS.

IPO values Foxtons at £649m

The public listing of BC Partners-backed Foxtons has valued the company at ТЃ649m.

Oaktree's Bellpenny picks up KMF

Bellpenny, a wealth manager backed by Oaktree Capital, has acquired Glasgow-based KM Financial Advisers (KMF).

BC brings in the banks for Foxtons float

BC Partners has hired Credit Suisse, Numis Securities and Canaccord Genuity to handle the flotation of London estate agency Foxtons.

PAI scoops up R&R Ice Creams

French large-cap specialist PAI partners has struck a deal to buy British ice cream manufacturer R&R Ice Cream from Oaktree Capital for тЌ850m.

Oaktree's R&R Ice Cream buys Fredericks Dairies

R&R Ice Cream, the ice cream manufacturer owned by Oaktree Capital, has wholly acquired Fredericks Dairies for ТЃ49m.

Countrywide's IPO pricing at top of range

Private equity-backed estate agent Countrywide has narrowed its IPO pricing at the upper end of its range.

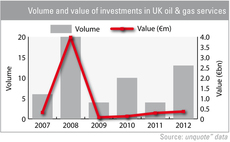

Private equity to benefit from oil & gas boom

The high price of oil could provide a boom to many operating in the oil & gas sector in the UK, and private equity players are looking to take advantage of the opportunities it offers.