Proskauer

Travers Smith bolsters funds practice with hire from Proskauer

Tosin Adeyeri joins with particular experience in secondary portfolio transactions

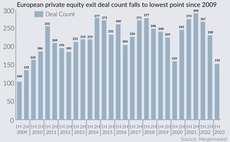

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

FPE sells IWSR to Bowmark Capital

FPE Capital acquired the business in April 2018 and Allied Irish Bank provided acquisition finance

Lugard Road invests $73m in Investcorp-backed Ageras

Transaction reportedly gives the company a valuation of around $244m

Investcorp-backed Impero acquires Netop

Acquisition was made partly to internationalise Impero's business, particularly in the US

Pollen Street sells SRG to HGGC

Deal represents a full exit for Pollen Street Capital, which was invested in SRG through its third fund

Video: Proskauer's van Zyl discusses fund formation trends

The Proskauer partner recaps the firm's mandates over the past year and how the market reacted to the coronavirus crisis

Hg closes Saturn 2, Mercury 3 and Genesis 9 on hard-caps

Proskauer provided legal advice and Rede Partners acted as placement agent for the three funds

Priveq holds first and final close for sixth fund

Vehicle will be used to develop growth companies with a turnover of SEK 100m-1bn

Tenzing closes second fund on £400m

Fund had a target of ТЃ350m with a hard-cap of ТЃ400m and was raised in nine weeks

Spectrum Equity IX hits $1.5bn hard-cap

Fund targets investments in internet-enabled software and information service companies

Atomico closes fifth-generation fund on $820m

Atomico V is the largest of any Europe-based venture fund in 2020, according to Unquote Data

Searchlight invests in Penta-backed GRP

Searchlight will take a majority stake, with other investors taking minority positions

G Square closes third fund on €500m

Investors in the fund include Adams Street Partners, Banca March, Cresta and Goodgrower

Mid-market stays loyal to English limited partnership

Luxembourg structures may have their proponents, but the Brexit drama does not seem to have dented the appeal of the English partnership

Sidley hires Proskauer partner

Eleanor Shanks joins Sidley Austin's private equity practice from Proskauer Rose

When, whether and how PE sponsors should implement blockchain for portfolio companies

Unquote sister publication Private Equity Law Report speaks to two experts at Proskauer

Proskauer appoints Moghli as partner

Moghli will advise fund sponsors and financial institutions on fund-formation matters

Rubicon sells Farsound Aviation to AGIC for £115m

Aviation-focused supply chain management company was reportedly marketed based on ТЃ11.4m EBITDA

Investcorp acquires Ubisense's SmartSpace for up to £35m

Deal for the location software and hardware developer is the GP's fifth from its fourth tech fund

Motive Partners backs Finantix

Following the deal, the company's founders and management team will continue to lead the business

Hg Saturn holds final close on £1.5bn hard-cap

Software-dedicated vehicle is already 40% deployed across investments in Visma and Iris

GIC et al. in $100m round for Acorn OakNorth

Latest funding round values the digital challenger bank at around $2.3bn, three years after inception