Return of the capital overhang?

With firms managing to raise large amounts of cash despite the troubled fundraising market, concerns are growing as to whether there are enough deals in the market.

With Apax set to close its latest fund on €6bn in the coming weeks, all talk is of how erstwhile titans are raising mere fractions of their predecessor vehicles. Apax had initially targeted €9bn, very close to the €11.3bn it had raised in 2007. Permira recently hit €2.2bn for a first close on its latest fund and expects to reach €4bn, less than half their 2006 vehicle.

To rub salt in to the wound, some mid-market players are reaching their hard-caps: HgCapital just raised £2bn, surpassing the £1.9bn it raised just three years ago. Further down the value spectrum, German mid-market player Afinum hit €280m against a €250m target.

The fundraising market is indeed polarised, but to assume the larger the firm the harder it will fall is to oversimplify. For example, Warburg Pincus just raised $11.2bn (a gentler haircut than others took on predecessor vehicles) while Enterprise Investors raised just €314m for its Fund VII – less than half its predecessor, though it is a mid-market fund.

The fact is that vast sums are still being raised. Last year saw three funds raise €20bn between them (BC, Cinven and Advent).

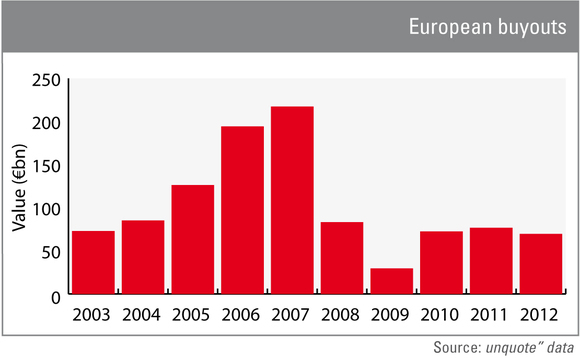

Though many funds are substantially smaller than their predecessors, dealflow is smaller still. For example, the value of buyouts in Europe in 2010-2012 was near €70bn each year, around the values seen in the early noughties and suggesting this may be the new norm (see graph). It is just over a quarter of the €270bn recorded in 2007.

Does this mean we're entering a new wave of capital overhang?

Perhaps. But leverage – a lack of which may be part of the reason deal activity struggles to break the €70bn mark – may be returning in the form of myriad funds. The last month has seen six debt vehicles raise more than €2.5bn for backing European LBOs, suggesting Europe is following the US market's footsteps in this regard.

Indeed, leverage is frothing again for larger deals; multiples are up, PIK is back in capital structures, and covenant-lite loans have accounted for more than half of leverage loans so far this year in the US, according to Moody's – twice the level seen in 2007. In a nutshell, some boom-time attributes are back.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds