Life sciences: testing times ahead?

Pharmaceuticals and biotechnology have fared marginally better than other sectors during the global recession, but the last two years have still been lacklustre for private equity investments in life sciences. However, with a healthy number of deals already this year, what is on the cards for the rest of 2010? Greg Gille reports

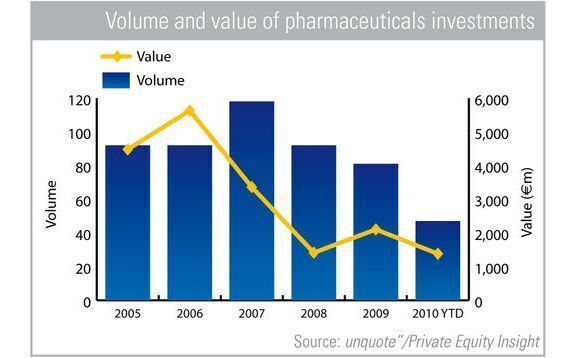

As in many other sectors, the top end of the market struggled most in both 2008 and 2009. Buyouts certainly halved; unquote" only recorded four each year, down from a 10 per year average between 2005 and 2007. Expansion deals were also scarce, with 16 in 2008 and 18 in 2009, compared to an average 35 per year recorded between 2005 and 2007.

On the upside, early-stage investments remained in line with pre-2007 levels. 2009 saw 54 venture capital investments, a marginal improvement over the 46 per year average recorded between 2004 and 2006. If anything, the hike to around 70 investments a year in both 2007 and 2008 appears to be the anomaly. Venture capitalists remained active throughout the crisis, betting strategic investments in innovative businesses would prove fruitful in the coming years. Michiel de Haan is a partner at Aescap, a venture capital firm that recently took part in the €30m funding round of Biocartis. Commenting on the sustained early-stage investment in the sector he said: "We are interested in companies that are very ambitious and we therefore aim for the long term. If you want to be a successful venture firm in life sciences, you cannot look for exits on the short term."

This focus on small, early-stage deals reflected on the value of the transactions recorded: the average value dropped by half between 2007 and 2008, from €28m to €15m. A €26m average for 2009 was skewed by some very large deals, such as the €1bn Marken mega-buyout. Excluding this buyout gives an average of just €12m per deal.

As the venture capital and private equity markets begin to recover, 2010 has been more promising. So far this year, there have been five buyouts, already topping both 2008 and 2009. The year started with a bang from Charterhouse Capital, which bought Deb Group from Barclays for a generous £325m. Other notable deals include AAC Capital's £100m acquisition of Martindale Pharmaceuticals, as well as the £400m Cerba Lab buyout by PAI Partners.

As far as venture investments are concerned, the 27 early-stage and 14 expansion deals recorded in the first half of 2010 point to a return to pre-crisis levels of activity, in both volume and value. De Haan highlights the strengths of Europe for the near future: "The life sciences investment area has a very favourable outlook, with an ageing population and a growing need for better medicine and better healthcare; emerging countries also offer growing opportunities for European life sciences firms. Technology has always been better in Europe than in the United States; what has been lacking for the last 20 years and has now turned in our favour is the human capital."

That is, of course, if investors stay on track - for a looming hurdle might test their resolve to support innovation through the economic slowdown. The AIFM Directive is certainly a cause of concern for venture firms; portfolio disclosure in particular is seen as a major competitive disadvantage for innovative companies, left open to the prying eyes of competitors. The EVCA is vocally opposing the directive and warns that many venture firms could stop investing altogether. "Small start-ups are hit the hardest by regulation which is aimed at big banks and large private equity houses. It is really alarming how governments on the one hand urge us to promote innovation, and on the other hand make it very difficult for investment companies," de Haan adds. However, he leaves the door open to optimism: "It hurts, but obviously we have to get over it."

It seems that life sciences will keep attracting investors in the coming months, especially from the venture capital community. All eyes are now turned to the September vote on the AIFM directive, with pharmaceuticals firms and investors hoping the rules will not prevent cash flowing into this vibrant sector.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds