Mid-market up a third year-on-year

Amid a modest overall recovery for European buyouts, the mid-market space has so far performed strongly in 2011. Greg Gille investigates

According to unquote's database Private Equity Insight, mid-market buyout activity - here defined as deals valued in the €50-500m range - has increased by a third in volume and nearly 40% in value compared to the same period last year, with unquote" recording 117 deals worth an overall €18.9bn from January to July.

This makes the segment a fairly strong performer amid a more modest recovery for overall buyout activity, which has grown by just 18% in volume compared to the first seven months of 2010.

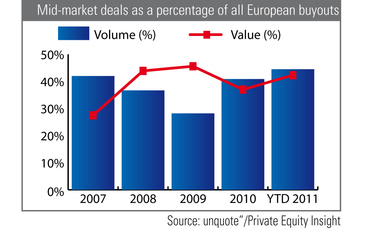

As a consequence, the volume of mid-cap deals as a proportion of overall buyout activity is at its highest in many years: such transactions account for 44.5% of all buyouts so far in 2011 compared to 41% in 2010, 28.2% in 2009, 36.7% in 2008 and 42% in 2007.

Value-wise, mid-market deals aren't as prevalent as they only represent 42% of the overall amount invested in 2011 - as opposed to 46% in 2009 for instance. This would highlight the startling recovery of the large-cap segment in 2011, which has helped push up overall value, with several multi-billion euro deals completed over the past few months.

Of the three largest European markets, France is the one that witnessed the strongest push in mid-cap activity from January to July. The country was home to more than a quarter of all mid-market buyouts - this puts it on par with the UK and marks a significant increase on the average 17% France accounted for in previous years. Strong performers in this country include Bridgepoint Development Capital (with three deals worth €330m) and AXA Private Equity (with two transactions worth €505m).

Having hit the ground running in 2011, the European mid-market space also seems on track to match 2008's activity levels. Mid-cap deals completed in the first seven months of the year historically account for around 60% of the yearly total, in both volume and value. Extrapolating on this trend, mid-cap deals should break the 200 mark in volume and exceed €31bn in value by the end of 2011 - which would almost put them on par with the 217 mid-market deals worth €32bn witnessed in 2008, before the market plunged in the wake of the financial crisis and global recession.

This will of course depend on the UK market's recovery rate. Traditionally the locomotive of Europe's mid-market, the country has experienced a slow start this year, and industry participants aren't expecting things to heat up significantly in the next six months. But provided the rest of Europe stays on track, the mid-market segment should live up to the expectations of many PE players, who billed it the next "industry hot spot" following the downturn.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds