Debt markets go full circle

With senior leverage loans on the secondary debt market trading at around par, investors are returning to the primary market. Emanuel Eftimiu reports

The secondary debt market has been a virtual mainstay on conference agendas over the past year. The market turmoil following the Lehman collapse at the end of 2008 resulted in a chill that gripped the primary market. The secondary debt space was subsequently flooded with assets from distressed sellers, as capital adequacy ratios became the main priority for financial institutions and CLOs increasingly looked for liquidity to avert defaulting.

The huge imbalance between buyers and sellers consequently resulted in large discounts for assets, with the ELLI (European Leverage Loan Indices) reaching record average lows of 60 just 12 months ago. For those able to take advantage of the disrupted market, such discounts represented a truly once in a lifetime investment opportunity.

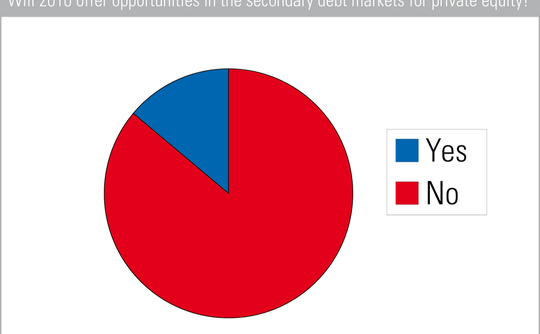

What a difference 12 months can make. Average pricing on the secondary debt market has seen a strong recovery and many senior leveraged loans are now trading near or even above par. Indeed, the latest unquote" survey reveals opportunities in the secondary debt market have truly dried up. Only 15% of respondents are expecting to find bargains on the secondary debt market in 2010. Instead, many investors have looked to high-yield prospects or are starting to return to the primary market.

The recent completions of sizeable transactions, such as Pets at Home in the UK for £955m and Ambea in Sweden for €850m, suggest a renewed appetite for new issuance among the leveraged finance community. Indeed there is anecdotal evidence that the leverage market is gaining in depth as institutional investors are returning and underwriting is starting to commence again, if only at a limited level.

That said, as Michael Jonson of Augusta noted at a roundtable discussion at the end of last year, investors are conservative to start with but evidence shows that their memories are rather short, which is why the market keeps going through cycles. "You start with the smaller and safer transactions and gradually people get comfortable with a bit more size and a bit more risk. The leverage starts to go up slightly, the pricing starts to come down and the cycle begins again."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds