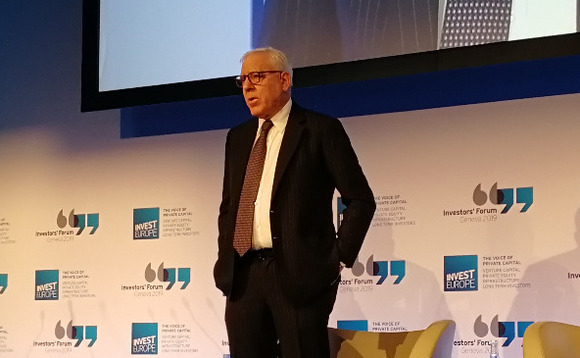

PE to continue enjoying strong tailwinds, says Carlyle's Rubenstein

Speaking at the Invest Europe Investors' Forum in Geneva yesterday, Carlyle Group founder David Rubenstein said he does not foresee private equity's current run of form ending soon т and reiterated his call for a second referendum on Brexit. Greg Gille reports

"This is a really strong environment for PE right now," Rubenstein said, addressing delegates as the closing keynote speaker. "Investors have internalised that the asset class performs consistently well in both good and bad times."

Rubenstein does not see a potential macro correction on the horizon as a significant threat, but rather as further opportunity for private equity: "Investors are increasing allocations to PE, especially as a potential slowdown looms. Given PE's outperformance compared with the public markets, investors are loading up in anticipation."

Rubenstein listed a number of factors further boosting PE's appeal in the current environment. These include the growing clout of sovereign wealth funds and large family offices, which are keener to allocate large pockets to PE compared with other traditional investors.

Meanwhile, investors' more modest returns expectations are also a boon: "When they may have been looking for 20-25% net in the past, investors are now accepting lower returns. That also means that higher entry multiples and their potential impact on future returns are not really penalised by investors at the moment."

Rubenstein did note that there could be challenging times ahead for some portfolio companies in the event of a downturn, but said the very high proportion of cov-lite leverage packages in the market at the moment should help soften any potential impact.

Finally, Rubenstein believes "the bloom has come off the rose" on emerging market opportunities, which should keep benefiting US and European GPs: "Now that the performance data has built up, we can see that while there is greater risk in emerging markets, these investments do not necessarily generate significantly better rates of return overall."

In an informal address frequently drawing laughter from the room, Rubenstein also reiterated his preference for a second public vote on Brexit, which he has expressed publicly in the past – this time by reading from a fictional letter by Winston Churchill: "British voters should be given a choice to vote on whether to leave or remain, this time considering the information available on the impact of the decision."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds