Private equity-backed IPOs, 2000-2011

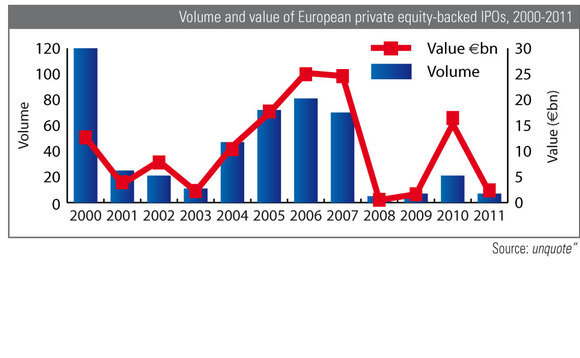

In appreciation of Facebook's massive IPO last week, unquote" data shows the volume and value of private equity-backed IPOs from the dot-com bubble through the financial crisis of 08/09, up to last year.

What is interesting about the graph above is that volume and value of IPOs have little correlation except in very slow periods. In 2002, IPO values rise, ending on a slump in 2003, before the market picked up again.

The financial crisis shattered the IPO market in 2008 and 2009; 2010, however, under the assumption of a recovery, saw 10 times the value and three times the volume of the previous year.

But as the recovery stalled and the European sovereign debt crisis erupted, 2011 saw a return to the poor performance of 2009.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds