Healthcare investments wane after strong Q2

Investment in the healthcare industry is facing tough times as total deal value falls to its lowest level in 18 months.

Healthcare is an industry that has traditionally enjoyed a reputation as a crisis-proof safe-haven. When times are hard, many say that healthcare and technology investments are a good choice, mostly because of societal demand in, for example, medical research.

But as economic conditions worsen, the healthcare sector is also struggling.

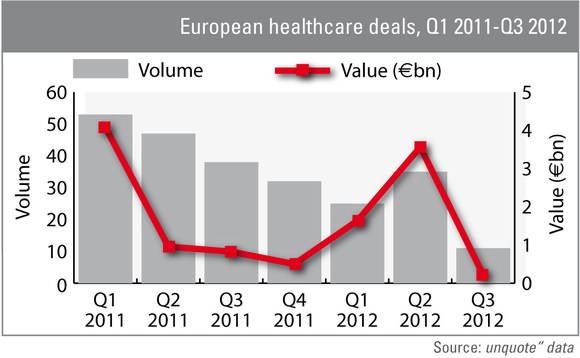

Having experienced declining dealflow since Q1 2011, the industry saw a surge in activity at the beginning of this year. Indeed, with 35 deals totalling more than €3.5bn between April and June 2012, investment almost reached the peak of the previous year.

Following the success, however, was the slump. Healthcare investments fell to an all time low in the time period considered, some of which may be attributed to the slow summer business.

But the field is dealing with more than just crisis-related issues. As unquote" reported, the British healthcare industry is bracing itself for major reforms, which could potentially change the investment landscape forever.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds