Investments by regional funds

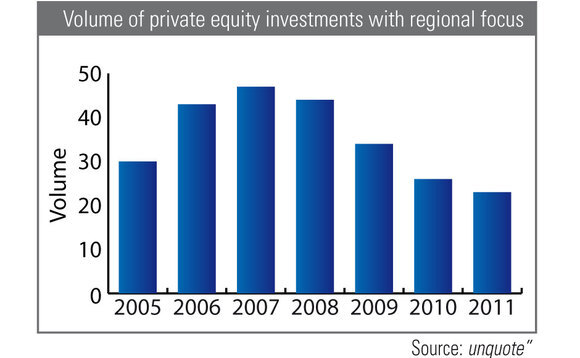

The volume of investments backed by regional initiatives has followed the general market curve of recent years: after the boom year of 2007, they plunged.

Moreover, deal numbers continued falling in 2011, a year which was slightly stronger than 2010 in terms of buyouts overall.

But regional focus is very important in times of economic turmoil. As financing is not as readily available as before, something must bridge the gap until the economy is more affluent again. PE houses with a regional focus can fill this role, drive local development and thus strengthen the economy from the bottom up.

Despite this and a number of government initiatives, regional investments have continued to decline since the 08/09 crisis.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds