Financials regain traction in summer

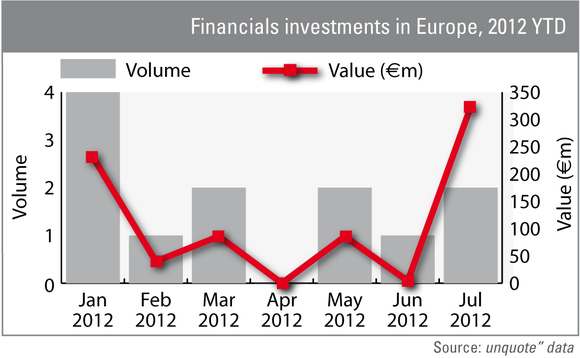

After a strong start in January, investments in financials slumped in both volume and value, following a bumpy path before gaining some more traction again in July.

While January saw the highest deal volume of 2012 so far, July surpassed it in value, with a total of more than €320m.

The largest deal of July and the year to date, was the buyout of Resurs Holding by Nordic Capital. The acquisition of the commercial financing and insurance provider was valued in the range of €250-500m.

But most deals in the financials sector belonged in the small cap category, feeding into the general impression of declining deal size due to economic constraints.

Looking back to 2011, May was the most active month for investment in this sector, accounting for more than €2bn in deals. But despite the €1bn mega-buyout of French real estate firm Foncia led by Bridgepoint, many deals in 2011 were also in the lower value bound, indicating long-term downward movement in financial services deal values.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds