DACH investment leaps forward in May

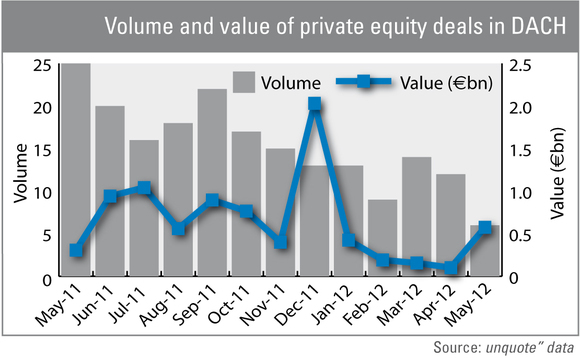

Investment in the DACH region surged forward in May, with seven deals worth an estimated €580m, compared to 12 deals worth just €100m in April.

t-cell Europe GmbH (€1.45m) and Algiax (€4.3m) marked the ongoing dominance of HTGF in the German early stage segment, as noted last month.

Meanwhile, Speech Processing Solutions (est < €500m) backed by Invest AG and ASC International House were the largest buyouts noted in Austria and Swtizerland respectively for quite some time. Qundis Group, backed by Hg Capital Trust with €160m, and Pinnova Capital's acquisition of Norafin Industries were the most noteworthy buyouts in Germany.

On the sector front, investment was mostly dominated by biotechnology and electronic equipment and renewable energy, which make up for the bulk of the region's transactions.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds