Successful exits bring venture back into the game

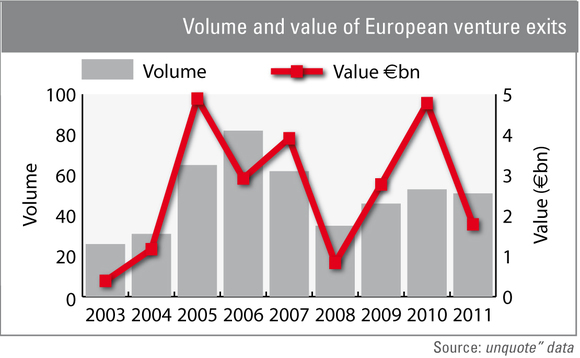

Venture is bouncing back since its 2008 trough, and now sees over 50 exits per year in Europe. These exits are not just about quantity, but also quality, with some of Europe's best-loved VCs sharing the limelight with lesser known players.

DN Capital is one of these. Its sale last year of Endeca to Oracle for $1.1bn retuned nearly two thirds of DN's first fund, or three quarters of total capital committed in dollars. DN isn't a one-trick pony, though: earlier this year, the GP sold Apsmart to Thomson Reuters in a deal that saw the vendor reap a reputed 20x money. And its sale last year of Datanomic generated a three-digit IRR. These are just three of the GP's seven exits in the last 18 months.

Life sciences and technology investor Advent Venture Partner has also had a phenomenal run. Last July, Advent sold Zong to eBay for $240m, giving Advent a 7.7x return and 61% IRR. That deal marked the end of a stellar year for the VC, which saw it sell The Foundry to Carlyle Group for a reported triple-digit IRR. Most recently the firm sold Avila, EUSA and Vitrue, all to trade buyers.

Earlier this year, Sofinnova sold BlueKiwi Atos SA Group. The exit came just weeks after Sofinnova floated DBV Technologies on NYSE Euronext Paris, though all the cash raised in the oversubscribed listing was re-injected into the business. The GP exited six businesses in 2010 and 2011, with notable disposals including Corevalve (9x), Stentys (4.7x) and Preglem (4.5x).

Last summer saw SEP and DFJ Esprit sell Zeus to Riverbed Technology for $140m, corresponding to 10x current year revenues. The vendors each reaped double-digit multiples for the deal, which they backed at different times. In the Nordics, tech investor Creandum sold Nanoradio to Samsung Electronics earlier this year.

This article is an extract from a more in-depth look at European venture. Click here to keep reading

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds