Private equity continues to shy away from renewables

Declining dealflow confirms the industry's move away from alternative energy, despite two headline deals pushing aggregate investment value in 2015. Vidur Sachdeva reports

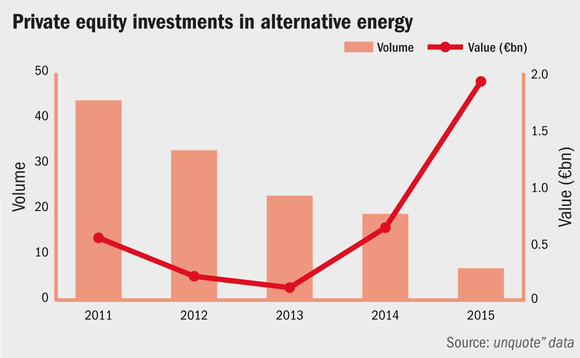

Back in May 2015, unquote" reported on institutional investors' waning interest in the renewable energy sector over the four years to the end of 2014. Dealflow in the sector had risen sharply during 2007-2010, before witnessing a dramatic decline in the subsequent four years to the end of 2014.

Latest estimates from unquote" data confirm that this trend extended into 2015 with only seven deals reported in the sector during the year. These seven deals remain 89% below the peak of 64 deals noted in 2010.

In sharp contrast, aggregate deal value surged to an all-time high of €1.9bn thanks to two sizable buyouts: KKR's €894.4m acquisition of an 80% stake in solar energy projects operator Gestamp Asetym Solar in July 2015; and US-based private equity firm Centerbridge Partners' €1bn acquisition of German wind turbine maker Senvion in January 2015. Collectively, these two deals accounted for 98% of the aggregate deal value in the sector during 2015.

Troublesome troika

Three main reasons are usually put forward to explain the bleak levels of investments in renewables by private equity players: the limited room for transformation the sector offers GPs; the relatively lower risk-return profile of the investments; and the longer time horizons associated with these investments.

Speaking to unquote" in February, Ambienta managing partner Nino Tronchetti argued that clean energies are simply not a good fit with the private equity model: "It doesn't work. The returns are not acceptable for private equity. As a GP, I simply can't invest where subsidising is involved, I can't base my strategy on policy."

That is not to say that the wider cleantech space is losing its attractiveness. provided GPs know where and when to look. "First, stay away from early-stage cleantech," Jadeberg Partners principal Daniel Koppelkamm told unquote" in February. "It is too capital-intensive, technology risk tends to be high and businesses take very long to scale up. Once they are profitable, once they get to the stage where they could grow out of their own cashflow, then you step in and accelerate that growth."

You can read further insight from Tronchetti and Koppelkamm in our recent two-part feature that takes a more in-depth look at why private equity has avoided renewables and which areas of the green economy are more suitable for investment.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds