Articles by Alessia Argentieri

Quadrivio acquires fashion brand GCDS

GP deploys capital from Made in Italy Fund, which targets companies across the fashion, design and food industries

Capvis buys Arag

GP invests in the company via Capvis Equity V, which held a final close on €1.2bn in September 2018

MCH sells Lenitudes, invests in Atrys

Sale ends a six-year holding period for MCH, which acquired a 66.5% stake in Lenitudes via its third fund

Portobello Capital raises €350m secondaries fund

Fund is dedicated to promoting the growth of Angulas Aguinaga and Industrias Alimentarias de Navarra

DeA Capital buys Gastronomica Roscio

This is the first deal inked by the GP via Taste of Italy 2, which recently held a final close on €330m

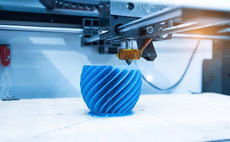

HTGF et al. lead €2m round for All3DP

Company intends to launch an international financing round, which is scheduled for 2021

Värde Dislocation Fund closes on $1.6bn

Fund has a global mandate to pursue a mispriced, stressed and distressed credit

PAI acquires Angulas Aguinaga from Portobello

PAI invests in the company via its PAI Mid-Market Fund, which recently held a €500m first close

Agilitas sells Exemplar to Ares Management

Sale ends a four-year holding period for Agilitas, which backed the company via its Agilitas 2015 Private Equity Fund

All Iron Ventures I closes on €66.5m

Fund invests in innovative B2C companies, primarily marketplaces, e-commerce specialists and SaaS startups

Initiative & Finance appoints Ardian's Pihan as partner

Pihan joins the firm's mid-cap team, which leads the strategy of Tomorrow Private Equity Fund

Endless buys Hovis from Gores, Premier Foods

Endless invests in the business via its Endless Fund IV, which closed on £525m in December 2014

Hg exits Eucon to trade

Sale ends a four-year holding period for Hg, which backed the company via its Mercury Fund

Taste of Italy 2 closes on €330m

Taste of Italy 2 will invest in companies specialised in the food and beverage sector, across its entire value chain

Fountain Healthcare Partners III closes on €125m

Fund is dedicated to investments across the life sciences sector, with a focus on therapeutics and medical devices

Archeide launches €50m VC fund

Fund will target Italian startups developing innovative products and applications

Clessidra buys Coefi from Archeide

Sale ends an eight-year holding period for Archeide, which has supported the growth and expansion of Coefi since 2012

Mutares carves out two units from Gea Group

Deal includes the companies' sites located in France and the Netherlands, with a total of 230 employees

Italy Fundraising Pipeline - Q4 2020

Unquote compiles a round up of the most notable fundraises ongoing across the Italian market

Orienta backs engineering specialist LMA

With Orienta's support, the company plans to further boost its expansion, both organically and via new acquisitions

360 Capital to launch €50m Square II fund

360 Square II will deploy equity tickets of €500,000-3m, primarily across France and Italy

Agilitas buys TenCate Armor from Gilde's Royal TenCate

This is the sixth platform deal made by Agilitas via its second fund

Sherpa appoints Medina as operating partner

Medina joins Sherpa's portfolio management team, with the role of adding value to the firm's investee companies

Motion Equity to take Olmix private

GP intends to launch a voluntary offer with the aim of de-listing the company by the end of 2020