Articles by Alessia Argentieri

PAI buys Grand Frais grocery business EEF

PAI intends to support EEF in accelerating its growth plans, both organically and via external acquisitions

CVC, Advent, FSI to buy Serie A in €1.7bn deal

Consortium will acquire a 10% stake in a new media company, which will manage Serie A's broadcasting rights

Clessidra launches fourth buyout fund

Fund will acquire majority stakes in profitable companies with high-growth potential

Knight Capital leads €10m series-B for Smart Protection

Swanlaab Venture Factory and CDTI also take part in the round, alongside previous backers including Nauta Capital

Eurazeo buys Altaïr from Motion Equity for €115m

Sale ends a four-year holding period for Motion Equity, which bought the company from Azulis, Gimv and co-investors

Covid-19, oversubscribed funds fuel interest in early secondaries

Early secondaries are tipped to become more plentiful in the coming months, but market observers urge caution to mitigate potential pitfalls

Consilium launches €100m fourth fund

Fund targets Italian mid-market companies and provides equity tickets in the €15-20m range

Bregal leads $53m series-C for Paack

Previous investors Unbound, RPS Ventures, Rider Global and Fuse Ventures also take part in the round

Eurazeo exits Iberchem in €820m deal

Sale generates a cash-on-cash multiple of 2.1x and a 25% IRR for Eurazeo Capital

Mutares exits Nexive in €60m deal

Mutares and Dutch mail company Postnl sell the entire share capital of Nexive to Poste Italiane

Aksia buys Nappi

This is the fourth acquisition made by Aksia Capital V, following its investments in Primo, Valpizza and Vomm

KKR backs CMC Machinery

GP invests in the company via KKR Global Impact Fund, which held a final close on $1.3bn in February 2020

Faber launches €30m second tech fund

Fund is dedicated to early-stage rounds, with a focus on data science, artificial intelligence and machine learning

Charterhouse buys Novetude Santé

GP intends to boost the company's growth, bolster its international expansion and pursue a buy-and-build strategy

Aglaé, BPI France lead $30m series-B for Livestorm

Raise Ventures and Idinvest also take part in the round, which brings the total amount raised by Livestorm to $35m

Turenne backs ABL Lyon

GP invests via Turenne Capital Santé 2, a healthcare-dedicated fund with a €165m hard-cap

Quadrivio acquires fashion brand GCDS

GP deploys capital from Made in Italy Fund, which targets companies across the fashion, design and food industries

Capvis buys Arag

GP invests in the company via Capvis Equity V, which held a final close on €1.2bn in September 2018

MCH sells Lenitudes, invests in Atrys

Sale ends a six-year holding period for MCH, which acquired a 66.5% stake in Lenitudes via its third fund

Portobello Capital raises €350m secondaries fund

Fund is dedicated to promoting the growth of Angulas Aguinaga and Industrias Alimentarias de Navarra

DeA Capital buys Gastronomica Roscio

This is the first deal inked by the GP via Taste of Italy 2, which recently held a final close on €330m

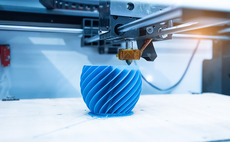

HTGF et al. lead €2m round for All3DP

Company intends to launch an international financing round, which is scheduled for 2021

Värde Dislocation Fund closes on $1.6bn

Fund has a global mandate to pursue a mispriced, stressed and distressed credit

PAI acquires Angulas Aguinaga from Portobello

PAI invests in the company via its PAI Mid-Market Fund, which recently held a €500m first close