Articles by Francesca Veronesi

Tamburi's Roche-Bobois announces IPO price range

Offering amount is €21.76m, and could be increased to €25.02m with overallotment

Eurazeo buys ST Group in SBO

UI Gestion sells its stake in the sensitive areas security specialist, renamed Vitaprotech

Alven, Otium back Feed in €15m round

Round of funding will help the health-focused startup to expand internationally

KKR's Webhelp bolts on Sellbytel

Backed by KKR since 2015, Webhelp buys outsourced sales provider Sellbytel Group

Anders Invest acquires De Waal Staal

Air tunnel specialist De Waal Staal is the 12th acquisition by Anders in three years

OpenGate sells NorPaper to trade

Lebanon-based Gemayel Freres & Chaoui Industriel buys the French paper specialist

Ace, CM-CIC sell Spring Technologies to trade

Sweden-based Hexagon, a specialist in Autonomous Connected Ecosystems (ACE) buys Spring

Amundi PE et al. back EMP Rotomoulage MBI

Brothers Cyril and Samuel Delamaire sell their stakes in the French plastic parts manufacturer

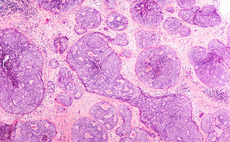

MPM et al. in €64m series-B for iTeos Therapeutics

Previous and new backers inject €64m in the cancer-focused biotechnology company

MBO Partenaires buys BCF Life Sciences

GP takes over from Céréa Capital and Sodero Gestion, investing alongside management

PE-backed SGH Healthcaring buys Rovipharm and RR Plastiques

SGH Healthcaring's double-acquisition is supported by a Bluebay financing package

France Invest seeks to capitalise on Macron's reforms

Trade body's newly appointed chair discusses plans to capitalise on reforms and bolster the popularity of the PE ownership model

DN Capital's Marovac named new Invest Europe chair

Marovac, the founder and manager of VC firm DN Capital, will chair the trade body until 2019

Omnes et al. in series-B round for Tiller

GPs will provide a €12m equity ticket and can deploy up to €8m in the next 18 months

Gilde acquires Elcee Group

Gilde will further support the company's acquisitive growth strategy and international expansion

EQT, PSP Investments buy Azelis in >€2bn deal

Apax is likely to generate a multiple in excess of 3.5x on the sale of its majority stake

Irdi Soridec, Axeleo Capital back Adagio

First round of funding from VC firms sees the startup rebrand from Onfocus to Adagio

MBO Partenaires buys-back Groupe LT

GPs Arkéa Capital, Amundi Private Equity and CEO Eric Van Acker acquire minority stakes

Trocadero et al. back Escalotel

Consortium of investors acquire the family-owned AccorHotels franchise business

FNB Private Equity buys Sud-Ouest Lartigue et Fils

French GP completes its second investment while approaching a final close for its maiden fund

CVC's Delachaux foregoes IPO, acquired by CDPQ

Although an IPO price range was announced last week, CDPQ ultimately acquires the business

Firstminute holds final close on $100m for seed fund

Follows a $60m first close in June 2017, and a second close on $85m in September

Omnes et al. back Mistral MBI

Transaction is the first investment from Omnes Capital's small-cap Omnes Expansion III fund

Omnes holds €30m first close for Omnes Expansion III

Omnes' third small-cap vehicle receives €30m in commitments from historic backer LCL