Articles by Katharine Hidalgo

PAI-backed Froneri buys Nestlé US ice cream business for $4bn

NestlУЉ will continue to manage its remaining ice cream operations in Canada, Latin America and Asia

Ada holds first close on £27m

Ada Ventures' founding partners, Francesca Warner and Matt Penneycard, met at Downing Ventures

Souter takes majority stake in Stone restructuring

Several LPs in RJD's fund have reinvested in the new vehicle, including the RJD partners themselves

Horizon acquires Ascent and TechHuddle for £30m

Horizon expects to merge the two IT services providers to create a business with 300 developers

Paine Schwartz invests in Warburton

Firm is investing from Paine Schwartz Food Chain Fund IV, which closed on $893m in 2014

Equistone-backed WHP Telecoms acquires Sitec

Equistone acquired WHP from Palatine Private Equity in March 2018, drawing equity from Equistone VI

NorthEdge sells DHG to ArchiMed for 3x return

During NorthEdge's holding period, the company made bolt-ons such as Nightingale, Kirton and Qbitus

NVM invests £11.6m in King Construction

NVM drew equity from its third-generation fund, which closed on ТЃ142m in November 2018

EIP hires Moosa for Europe expansion

US-based EIP hires VT's Nazo Moosa to work alongside Matthias Dill at EIP Europe

WestBridge invests £12.8m in Aptus Utilities

Aptus Utilities has also received financing from OakNorth Bank as part of this transaction

VCs in £7m round for Perlego

Perlego offers access to online textbooks for a subscription fee of ТЃ12 per month

Idinvest leads $50m round for Ogury

Idinvest is currently investing from its тЌ350m vehicle, which held a final close in October 2019

Exponent acquires KPMG pensions advisory

In November 2018, KPMG announced it would no longer provide consultancy work for its audit clients

Mobeus invests £4m in IPV

Calculus Capital invested тЌ2.5m in the media management software provider in 2015

Paris takes over London as VC capital of Europe

Greater Paris region received €3.1bn between 2007-2015, according to Invest Europe research

NVM sells VCT business for up to £25m

Mercia approached NVM four to five months prior to the acquisition to enter discussions

Albion sells Bravo Inns for £17.9m

Enterprise value of the company represents an entry multiple of 6.8x for the acquirer

Mayfair backs Parcel2Go

Following the investment, the company expects to organically grow in its three verticals

Umbra leads $20m round for Hastee

In addition to the equity investment, Hastee receives a $250m credit line from the investors

Goldman Sachs mid-market PE team makes hires

Esma Yildiz, who joins from Arma Partners, will head up mid-market sponsor coverage for the team

Arlington Capital acquires Firth Rixson

Arlington typically invests $25-75m in companies with enterprise values of $50-500m

VCs in £15m round for Cuvva

Cuvva has recently launched its first product, where customers pay monthly for insurance

UK-focused GPs getting creative with buyout sourcing

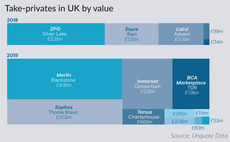

In 2019, 10 take-privates have been agreed in the UK and Ireland to date, up from five in 2018

Sovereign to sell Arachas for €250m

Sovereign backed the management buyout of Arachas in 2017 and acquired a controlling stake