Buyouts

GCS Capital buys Dexia Asset Management

Hong Kong-based GCS Capital has acquired Dexia Asset Management (DAM) from its parent company Dexia SA.

Silverfleet buys La Fée Maraboutée for €65m

Silverfleet Capital has acquired French womenswear specialist La Fée Maraboutée (LFM) in a €65m primary buyout.

Endless backs MBO of Vion Food UK

Turnaround player Endless has invested in the management buyout of Dutch food producer Vion's British pork business.

WestBridge backs £6m MBO of Anglia Business Solutions

UK SME investor WestBridge Capital has pumped ТЃ2.6m into the buyout of Cambridge-based Anglia Business Solutions in return for a 43% stake in the business.

iXO Private Equity backs MPS buy-in

iXO Private Equity has taken a minority stake in the management buy-in of French public toilets specialist Michel Plante Systèmes (MPS).

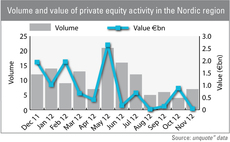

Frozen Nordic market

In just two years, Sweden has lost half of its deal volume, showing that even the popular Nordics are not immune from Europe's economic drag.

Palamon and Sirius buy feelunique.com

Palamon Capital Partners and Sirius Equity have acquired a majority stake in Channel Islands-based online beauty retailer feelunique.com, in a deal that values the business at ТЃ26m.

Trigon aquires 50% of PKM Packaging

Trigon Equity Partners has acquired a 50% stake in German packaging business PKM Packaging from company director Deniz Cevikalp, who retains the remaining shares.

FF&P sells US division of Harvest Media

FF&P Private Equity has sold Telescope Inc, the US business of audience participation services firm Harvest Media Group, in a management buyout backed by HIG Growth Partners and Moorgate Partners.

DBAG buys Plant Systems & Services PSS

Deutsche Beteiligungs AG (DBAG) has invested €5.6m for a 49% stake in German newco Plant Systems & Services PSS, with a further financing slated for the short- to medium-term.

Sponsored Video: P2Ps within reach – if prepared

Video: P2Ps

Karmijn Kapitaal backs MBO of YouMedical

Karmijn Kapitaal has invested in Dutch medical equipment company YouMedical as part of an MBO.

Apollo acquires Aurum Holdings

Apollo Global Management has acquired British jewellery retail Aurum Holdings from Landesbanki Уslands.

Quadriga to buy LR Health and Beauty Systems from Apax

Quadriga is the final bidder for German beauty products retailer LR Health and Beauty Systems (LR International), currently owned by Apax Partners, according to reports.

Trigon acquires Menz Holz

Trigon Equity Partners has acquired Menz Holz, a German provider of wood products for outdoor spaces, from insolvency.

NBGI buys cake business for £23.5m

NBGI Private Equity has backed the ТЃ23.5m management buy-in of McCambridge Group Holdings's cake division.

Blackstone buys Intertrust for €675m

The Blackstone Group has acquired Dutch tax consultancy Intertrust from Waterland Private Equity for a reported €675m.

US investor circles Topshop

Sir Philip Green, the owner of British clothing retailer Topshop, is reportedly in talks with US-based private equity house Leonard Green & Partners LP for the sale of a 25% stake in the business.

CD&R wins B&M Retail race

Clayton Dubilier & Rice (CD&R) has acquired a significant stake in the buyout of UK discount retailer B&M Retail, a deal rumoured to be valued around the ТЃ950m mark.

Baird buys The SR Group

UK-based mid-cap investor Baird Capital Partners Europe has invested in The SR Group, a recruitment services firm.

LBO France buys Alvest off AXA PE and Equistone

LBO France has acquired French industrial group Alvest from AXA Private Equity and Equistone.

Reiten exits Basefarm to ABRY

Nordic private equity firm Reiten & Co has sold Norwegian IT company Basefarm to US-based ABRY Partners.

Metric Capital Partners invests in Centric Health

Metric Capital Partners has invested тЌ20m in the MBO of Irish healthcare provider group Centric Health and its two subsidiaries Уras SlУЁinte and Global Diagnostics.

ICG backs MBO of ATPI from Equistone

The management team of UK-based travel management business ATPI has bought the company from Equistone with support from ICG.