Buyouts

Dunedin backs £34.5m MBO of Premier Hytemp

Dunedin has supported the MBO of Scottish oil and gas exploration equipment manufacturer Premier Hytemp from Murray International Holdings.

Ratos sells Contex to Procuritas for $41.5m

Ratosтs portfolio company Contex Group has signed an agreement to sell Danish Contex AS to the private equity fund Procuritas Capital Investor V LP for a total of $41.5m.

Lonsdale in MBO of funeral service provider Avalon

UK small- to mid-cap house Lonsdale Capital Partners has backed the MBO of Avalon Funeral Plans.

Alto makes 2x on Monviso SBO

PM & Partners Private Equity has acquired Italian food producer Monviso from Alto Partners.

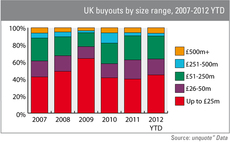

UK mid-market most affected by recession

The mid-market has suffered more during the double dip recession than other market segments, according to figures from unquoteт data.

Greensphere Capital backs Greenlight

Greenlight AD Power, a holding company behind a proposed anaerobic digestion platform, has raised ТЃ16m from Greensphere Capital, the sustainable energy-focused private equity firm chaired by Jon Moulton.

DBAG acquires Heytex Bramsche from NORD Holding

Deutsche Beteiligungs AG (DBAG) has acquired Heytex Bramsche, a German manufacturer of print media and technical textiles, in an SBO from NORD Holding.

Nazca buys Ovelar for €28m

Spanish GP Nazca Capital has wholly acquired visual merchandising company Ovelar Merchandising for €28m.

Innova and EBRD invest in EnergoBit

Innova Capital and the European Bank for Reconstruction and Development (EBRD) have taken over Romanian electrical engineering services company (ESCo) EnergoBit.

BlackFin acquires minority stake in Groupe Cyrus

BlackFin Capital Partners has taken a minority stake in the MBO of French wealth management firm Groupe Cyrus.

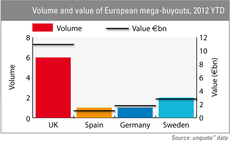

UK mega-buyouts worth more than €10bn this year

In defiance of problems on the continent, the UK has seen a surge in mega-buyouts this year, topped off with the recent acquisition of Annington Homes for ТЃ3.2bn.

Blue Sea Capital acquires Dom Zdavlja Dr Ristic

Blue Sea Capital has acquired Serbian private healthcare clinic Dom Zdravlja Dr Ristic.

Highlander buys ProService AT from Enterprise Investors

Highlander Partners has acquired Polish transfer agent ProService Agent Transferowy from Skarbiec Holding, a portfolio company of Enterprise Investors.

Elbrus Capital invests in SPSR-Express

Elbrus Capital has taken a stake in Russian delivery business SPSR-Express, leading to a partial exit of the Russian Retail Growth Fund.

H2 Equity Partners supports MBO of Hancocks

H2 Equity Partners has acquired British confectionery wholesaler Hancocks Group Holdings, alongside the company's management.

Mid-cap valuations dragged down by trade buyers

Valuations down

CBPE buys Xafinity Consulting

CBPE Capital has carved British pensions consultancy firm Xafinity Consulting out from Advent International-owned Equiniti Group.

AEA and Teachers' Private Capital buy Dematic from Triton

AEA Investors and Teachers' Private Capital, the private equity arm of the Canadian Teachers Pension Plan, have bought German logistics business Dematic in an SBO from Triton.

VTB-led consortium buys controlling stake in Vivacom

A consortium led by VTB Capital has acquired a controlling stake in Bulgarian telecoms operator Vivacom.

Miura PE backs MBO of GH Induction Group

Miura Private Equity has backed the management buyout of induction heating technology firm GH Induction Group from industrial holding company Corporación IBV.

Perusa buys Opcon division for SEK 218m

Perusa has acquired the engine efficiency division of Opcon, a Swedish energy and environmental technology group, for SEK 218m.

Quadrivio buys Suba Seeds

Italian buyout house Quadrivio has acquired a 52% stake in Suba Seeds, a distributor and manufacturer of vegetable seeds.

Rutland buys Pizza Hut

Rutland Partners has acquired the UK restaurants business of Pizza Hut UK Ltd from parent company Yum! Brands, making a ТЃ20m equity injection into the firm.

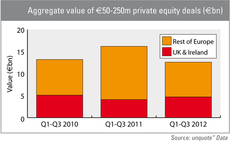

UK lower mid-market resilient in 2012

While activity in the тЌ50-250m segment has failed to improve on 2011 figures on a pan-European level, the UK is proving to be fertile ground for deal-making in an otherwise troubled macroeconomic environment.