Exits

Perfectis exits Fasia Industries in trade sale

Perfectis Private Equity has sold its majority stake in French professional clothing business Fasia Industries to French strategic buyer Groupe Marck.

Oaktree Capital buys Integrated Subsea Services

Oaktree Capital Management has acquired a 62.5% stake in Integrated Subsea Services (ISS), according to reports.

Capvis and Partners Group sell Bartec to Charterhouse

Capvis Equity Partners and Partners Group have sold their majority stake in German industrial safety technology provider Bartec to Charterhouse Capital Partners.

Revolymer IPO raises £25m

Revolymer, a British polymer company, has completed an IPO on the AIM market of the London Stock Exchange.

SBOs remain resilient in Q2

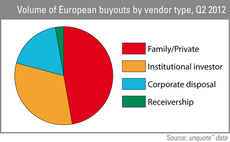

The increase in larger deals witnessed in the second quarter corresponded with a relative resilience in secondary buyout activity across Europe, according to the latest unquote" Private Equity Barometer.

RJD buys Harrington Brooks from Inflexion

RJD Partners has backed the MBO of British debt management firm Harrington Brooks from Inflexion Private Equity.

CapMan exits Ascade to CSG Systems

CapMan has sold software developer Ascade to NASDAQ-listed trade player CSG Systems.

Residex sells Best Fencing Group

Residex has sold its stake in Dutch industrials company Best Fencing Group back to management, according to reports.

Mid Europa completes €400m recap of Czech T-Mobile

Mid Europa has secured a further CZK 875m (€35m) from Austria-based Volksbank to complete the CZK 10bn (c€400m) recapitalisation of its minority stake in T-Mobile Czech Republic.

Permira sells Valentino to Qatari investors

Permira has sold Valentino Fashion Group to Mayhoola for Investments, a vehicle backed by a Qatari private investor group, in a deal believed to be valued at around €700m.

Argos exits Roc-Eclerc

Argos Soditic has sold French funeral services business Roc-Eclerc to a private investor and the company's management after a seven-year holding period.

G Square buys Mikeva from Intera

G Square Capital has acquired Finnish social care services provider Mikeva from Intera Partners.

Providence acquires HSE24 from AXA PE

Providence Equity has acquired Germany-based international home shopping group Home Shopping Europe (HSE24) from AXA Private Equity for an estimated €650m.

Maven reaps 3.7x on Nessco exit

Maven Capital Partners has exited telecommunications provider Nessco Group in a ТЃ31m trade sale to US-based RigNet, generating a 3.7x money multiple on its original investment.

BC Partners sells stake in Brenntag for €577.5m

BC Partners and co-investors have sold seven million shares in listed German chemicals company Brenntag, reducing their joint stake to 13.6%.

AXA PE nears €1bn Fives deal

Charterhouse is set to sell French engineering company Fives to AXA Private Equity and the company's management, according to reports.

Nova Capital Management exits Carbolite

Nova Capital Management has sold Carbolite Holdings to Dutch tech company Verder Group in a deal generating a gross equity return of 3.5x.

3i sells LNI stake for €36m

3i Group has sold its 5.7% stake in Lakeside Network Investments (LNI) to Teachers Insurance and Annuity Association of America for тЌ36m.

Providence to acquire HSE24 from AXA PE

Providence Equity Partners is to acquire a majority stake in AXA Private Equity-held German shopping channel Home Shopping Europe (HSE24), according to reports.

Octopus makes 2.5x money on AVM exit

Octopus Investments has realised its stake in British visual communications systems business AVM through an SBO backed by Alcuin Capital, returning 2.5x money to investors.

FSI Régions sells ISIFA to EduServices

FSI Régions has sold French vocational training and apprenticeships provider ISIFA to EduServices, a private post-secondary education provider backed by Duke Street.

EdRIP backs Edimark Santé OBO

Edmond de Rothschild Investment Partners (EdRIP) has taken a minority stake in the owner buyout of medcdtll, a newco regrouping French medical publishing companies Edimark Santé and Espace Information Dentaire.

Hellman & Friedman buys Wood Mackenzie in £1.1bn SBO

Hellman & Friedman has acquired a majority stake in UK-based consultancy Wood Mackenzie from Charterhouse in a deal that values the business at ТЃ1.1bn.

HgCapital and VSS exit SHL to CEB for $660m

HgCapital and Veronis Suhler Stevenson have exited psychometric testing company SHL to the NYSE-listed trade player Corporate Executive Board (CEB) for $660m.