Exits

Quilvest PE buys stake in Acrotec

Quilvest Private Equity, the private equity arm of French family-owned wealth manager Quilvest Group, has invested around CHF 30m in Swiss watch components maker Acrotec.

Caryle acquires Light Force

The Carlyle Group has acquired a majority stake in Light Force, the producer and distributor of women’s clothing brand Twin-Set Simona Barbieri, from DGPA Capital and the company’s founders.

ISIS sells Enotria to BlueGem

BlueGem Capital Partners has acquired a majority stake in British wine trade supplier Enotria from ISIS Equity Partners.

VCs exit Elbee in trade sale

XAnge Private Equity, OTC Asset Management and Nextstage have sold their stakes in French online home furnishings retailer Elbee to trade buyer Adeo.

Investindustrial exits Contenur

Investindustrial has exited plastic urban waste containers producer Contenur to Miura Private Equity and Demeter Partners of France.

AXA PE buys Novotema from 3i

AXA Private Equity has completed the secondary buyout of Italian rubber components manufacturer Novotema Group from 3i.

Cinven acquires Pronet Güvenlik from Turkven

Cinven Partners has acquired Turkish alarm systems provider Pronet Güvenlik in a secondary buyout from Turkven Private Equity and other institutional shareholders.

Blackstone exits Klöckner Pentaplast

Blackstone has sold its majority stake in German thermoform packaging company Klöckner Pentaplast to Strategic Value Partners.

3i exits Finnish outdoor brand Halti Oy

3i has sold its 49% equity stake in Finnish outdoor equipment company Halti Oy to Ingman Group.

Doughty raises $1.1bn from Norit sale

Doughty Hanson has sold activated carbon specialist Norit to US trade player Cabot Corporation for $1.1bn.

Eden Ventures et al. exit WE7 to Tesco

Eden Ventures has sold its minority stake in Peter Gabrielтs digital music platform WE7 to retailer Tesco.

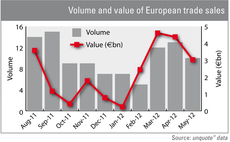

Trade sales on the rise

The partial sale of Alliance Boots to Walgreens by KKR and AXA PE is the latest in a series of exits propping up trade sale figures in 2012. Meanwhile the secondary buyouts trend is showing signs of abating. Greg Gille reports

Alliance Boots partial exit raises £4.3bn cash and shares

KKR and AXA Private Equity have made a partial exit from Alliance Boots following a cash and shares offer from US pharmaceutical retailer Walgreens.

Evonik cancels IPO

CVC-backed German chemicals maker Evonik has announced the cancellation of its planned IPO.

Eurazeo PME exits Mors Smitt

Eurazeo subsidiary Eurazeo PME has exited Franco-Dutch electronic rail equipment maker Mors Smitt to US manufacturer Wabtec, reaping a 3.5x money multiple on its initial investment.

LDC acquires Metronet from YFM

LDC has completed the management buyout of UK-based internet service provider Metronet from YFM Equity Partners and Acceleris.

Balderton dumps Sulake after documentary exposé

Balderton has dumped its stake in Finnish social networking company Sulake following a damning Channel 4 investigation into the firm.

CapMan Russia exits Tascom to trade player MTS

CapMan has exited Russian telecommunications firm Tascom to local trade player Mobile TeleSystems (MTS).

Market volatility threatens Evonik IPO

The RAG Foundation, which owns a majority stake in CVC-backed German chemicals maker Evonik, could cancel the company's IPO in light of the current market environment.

OMERS PE acquires Lifeways from August Equity

The private equity branch of Canadian pension fund OMERS has acquired British healthcare services provider Lifeways from August Equity.

Trade winds blowing

Trade winds blowing

VCs exit Esterel in €42m trade sale

CDC Innovation, Galileo Partners and Intel Capital have exited French software company Esterel in a €42m trade sale to US-based Ansys.

DN hits seventh exit in two years with Apsmart sale

DN Capital has exited UK mobile innovation company Apsmart in a trade sale to Thomson Reuters.

MML sells Industrial Acoustics to AEA

MML Capital Partners has sold noise control products manufacturer Industrial Acoustics to AEA Investors.