Expansion

Tikehau leads €150m investment in Amarenco

Pierre Devillard and Pierre Abadie from the private equity team of Tikehau will join the board

KCP invests £7m in Darts Corner

Key Capital Partners had been tracking the company for two years prior to investment

Innova acquires stake in Bielenda Kosmetyki

Proceeds from the investment will fund the company's acquisition of two cosmetics brands from Norwegian cosmetics group Orkla

Bridgepoint buys minority stake in Diagnostiskt Centrum Hud

GP will help the company's expansion further into the Nordic region

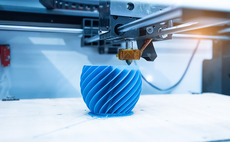

HTGF et al. lead €2m round for All3DP

Company intends to launch an international financing round, which is scheduled for 2021

SoftBank leads $250m round for Tier Mobility

VCs including Mubadala Capital, Northzone and RTP Global also back the e-scooter startup

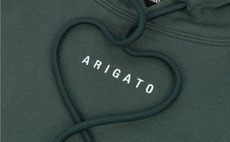

Eurazeo Brands buys majority stake in Axel Arigato

GP will own the company alongside its founders, Max SvУЄrdh and Albin Johansson

Crédit Mutuel Equity et al. invest €75m in Chausson Matériaux

Irdi Soridec Gestion, BNP Paribas, Grand Sud-Ouest Capital and Idia Capital also invest

FirstFloor et al. back €41m series-D for Skeleton

Latest round brings Skeleton's total funding to €93m since its inception in 2009

HAL backs two Dutch greenhouse businesses

Dutch investment company secures 60% stake in Stolze and a 24% interest in Prins Group

Motion Equity to take Olmix private

GP intends to launch a voluntary offer with the aim of de-listing the company by the end of 2020

Lugard Road Capital leads $32m round for InRiver

Company has raised around $56m in total funding and will use the latest proceeds to speed up growth to meet accelerated customer demand

CDP, StarTip, Vertis in €5m round for Buzzoole

Company intends to use the fresh capital to develop its new tool Discovery and further boost its expansion

Inflexion buys minority stake in Phenna

GP deploys capital from its dedicated minority investment fund, Partnership Capital II, which closed on ТЃ1bn in 2018

BGF, Perwyn et al. in £25m round for unicorn Gousto

Latest funding will be used for the development of Gousto's two new fulfilment centres and accelerate investment in automation

Searchlight leads €114m convertible note round for GetYourGuide

Existing investors including Softbank and Lakestar reinvest in the tourism booking platform

MIP leads €5m round for Exoticca

This round is an extension to an €11m series-B investment raised by the company in July 2019

Kartesia injects €75m into HeadFirst

Kartesia backs the recruitment company via its KCO IV and KCO V funds

United Ventures leads €6m round for Boom Imagestudio

Company plans to use the fresh capital to further develop its proprietary technology and boost its international expansion

Nord Holding's Jumpers Group buys Ai Fitness; forms BestFit

Combined companies will pursue a buy-and-build strategy, acquiring fitness studio chains

FJ Labs invests in car renting startup Vamos

Company intends to use the fresh capital to further boost its growth and expansion across the Spanish market

Grafton Capital secures majority stake in Third Financial

VC firm has so far invested ТЃ7m in Third Financial, which will use the latest funding to accelerate the growth of its platform

Palatine invests in Back2Work

Deal is GP's sixth investment from its ТЃ100m Impact Fund, which targets profitable businesses making a positive impact

Atwater invests in EQT-backed Freepik

GP intends to work closely with EQT and the management to support Freepik's growth and expansion