Deals

Altor buys Ideal of Sweden

Founders Joachim LindstrУЖm and Filip Ummer, and EEquity reinvest in the transaction

Genoa football club to be sold to York Capital

Genoa was put on the market by president and majority shareholder Enrico Preziosi earlier this year

Andera exits Erget in management buy-back

Erget is the 11th divestment from Andera's Cabestan vehicle, which closed on €113m in 2011

HTGF et al. invests in Simreka

Sap.IO, Sap's early-stage investment arm, also invested in Simreka with High-Tech Gründerfonds

Chiltern backs Perfect Image MBO

Founder of the Newcastle-based IT consultancy will continue in a non-executive capacity

EQT transfers IP-Only to infra fund

EQT makes the divestment from its EQT Mid Market and EQT Mid Market Europe funds

PEP's IDB buys interior design specialist Modar

Modar is the sixth bolt-on inked by IDB, which expects to reach a turnover of €130m in 2019

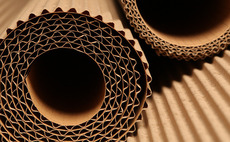

INVL invests €30m in Grigeo carve-out

Subsidiary of the fund will acquire 49.99% of the division's shares in a two-part transaction

Advent backs Spanish dental group Vitaldent

GP intends to accelerate the company's organic growth and strengthen its market position

Steadfast Capital backs BUK and UHB

Steadfast Capital invests in lower-mid-market companies with enterprise values of between €20-150m

SEP invests €25m in Immedis

Transaction will enable the Irish payroll software developer to double its headcount

Mutares to acquire Kico

Germany-based Mutares invests in companies with small profits and revenues of €50-500m

PE-backed Raffin bolts on Maison Milhau

Combined business of meat food products is expected to generate revenues of €80m

Galiena Capital acquires Cameo Energy stake

GP backs the primary buyout of Cameo Energy, a specialist in energy transition services

Innova to acquire majority stake in CS Group Polska

Deal is the fourth investment made from the GP's sixth fund, which has a €325m hard-cap

Ardian-backed Jakala acquires marketing specialist Volponi

Following Volponi’s acquisition, Jakala expects to further expand and reach revenues of €250m

Nazca buys biopharmaceutical company Diater in €45m deal

This is the fifth investment made by Nazca Fund IV, which closed on €275m in 2017

Fortino backs Maxxton

Fortino is currently investing from its Fortino Growth Capital II vehicle, which has raised €125m

YFM supports MBO of The Protein Works

GP's maiden institutionally backed fund is more than 70% deployed following the deal

Earlybird et al. in €15m series-A for Getsafe

Earlybird is currently investing from its Earlybird Digital West Fund VI, which closed on €175m

Vespa Capital backs Le Marché de Leopold MBO

Company’s founder sells his majority stake, while management invests alongside the GP

Triton exits steel waste recycling company Befesa

Sale ends a six-year holding period for the GP, which bought Befesa from recycling company Abengoa

WCAS exits Aim Software in €60m deal

Welsh, Carson, Anderson & Stowe acquired a majority stake in Aim Software in 2015

Preservation and BCI acquire BMS Group in £500m deal

Insurance brokerage group's management and staff will retain a significant minority stake